|

|

|

|

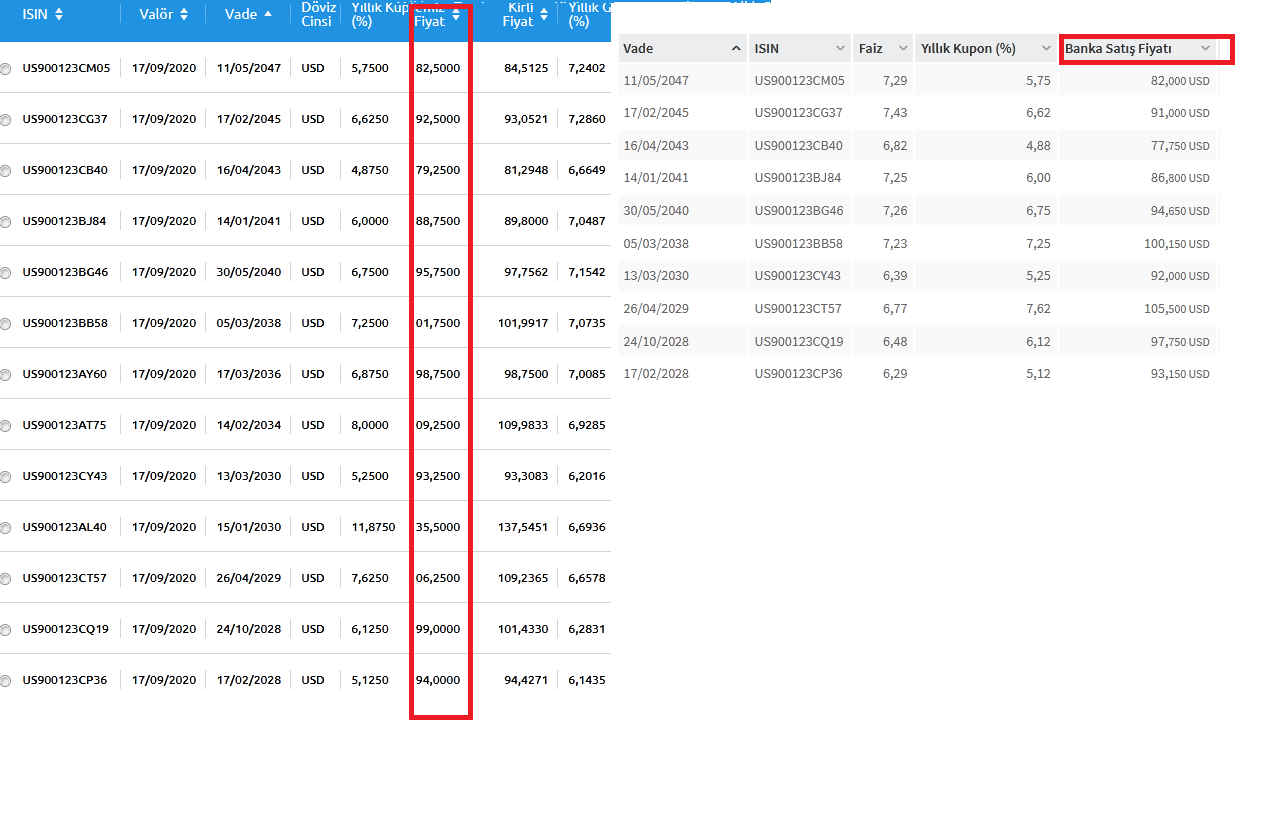

arkadaşlar merhaba, garanti ve yapı kredi fiyatları yan yana

Son düzenleme : 111222333; 15-09-2020 saat: 14:05.

En güçlü veya en zeki olan değil, DEĞİŞİME en açık olan türler hayatta kalır...Charles Darwin

https://twitter.com/r_x_p_u

Soldaki yapı kredi, sağdaki garanti. Ancak resimdeki veriler okunmuyor bendeLLD-L31 cihazımdan hisse.net mobile app kullanarak gönderildi.

Burada yer alan yatırım bilgi, yorum ve tavsiyeleri yatırım danışmanlığı kapsamında değildir.

En güçlü veya en zeki olan değil, DEĞİŞİME en açık olan türler hayatta kalır...Charles Darwin

https://twitter.com/r_x_p_u

Garanti, Teb ve Yapı Kredi bankasının Eurobond satış fiyatlarını görme imkanım oluyor. Bu üç bankayı karşılaştırırsam genelde Teb'in satış fiyatları daha iyi oluyor, Garanti bankası ara ara bazı eurobondlarda daha iyi fiyat verebiliyor. Teb'in satış fiyatı bir çok Eurobond için daha iyi olmasına rağmen alış fiyatı Garanti bankasına göre daha düşük oluyor. Alıp itfaya kadar tutacaklar için Teb, al-sat yapacaklar için Garanti daha önde gözüküyor. Yapı Kredi bankasını fiyat olarak kesinlikle tavsiye etmiyorum. Teb ve Garanti bankasından daha iyi fiyat verdiği tek eurobond görmedim baktığım dönem içinde. Bu yazdıklarım İnternet şubelerindeki fiyatlar için geçerli telefonla alınan fiyatlar konusunda bilgim yok.

Minimum işlem limiti olarak ; Teb 88.50 fiyatlı bir eurobond'u 1.000 nominal olarak almanıza izin verirken, Garanti bankası alt limiti 1.000 Usd, kirli fiyat 100 altında kalıyorsa minimum 2.000 nominal almanız gerekiyor. Yapı Kredi bankasından işlem yapmadığım için alt limiti konusunda bilgim yok.

Burada yer alan yatırım bilgi, yorum ve tavsiyeleri yatırım danışmanlığı kapsamında değildir.

Bugün 12 bankanın yabancı para kredi notu ülke notunun altına düşürülmüş. Normalde pek olan bir şey değil bu. Caa1 çok farklı bir seviye. Ratinglerde C harfini görmek pek istemem.

Rating Action: Moody's downgrades 13 Turkish banks; outlooks remain negative

15 Sep 2020

London, 15 September 2020 -- Moody's Investors Service has today downgraded (1) the foreign currency long-term deposit ratings of 12 banks in Turkey; (2) the long-term counterparty risk ratings (CRR) and the long-term counterparty risk assessments (CRA) of six banks; and (3) the long-term senior unsecured rating of one bank by one notch and the long-term foreign currency CRR of three banks by two notches. The standalone baseline credit assessments (BCAs) and other ratings of these banks and of the other four Turkish banks rated by Moody's are unaffected by this rating action.

Please click on this link https://www.moodys.com/viewresearchdoc.aspx?docid=PBC_ARFTL432558 for the List of Affected Credit Ratings. This list is an integral part of this Press Release and identifies each affected issuer.

The downgrades on the 13 impacted banks are driven by Moody's downgrade, on 11 September 2020, of the Government of Turkey's bond rating to B2 with negative outlook from B1 with negative outlook. The downgrade of Turkey's sovereign rating resulted in the lowering of the ceilings for foreign currency deposits to Caa1 from B3 and for foreign currency bonds to B2 from B1. For further information on the sovereign rating action, please refer to Moody's press release published on 11 September 2020: Moody's downgrades Turkey's ratings to B2 and maintains negative outlook (https://www.moodys.com/research/--PR_431146).

Moody's has maintained the Macro Profile it assigns to Turkey at Very Weak+.

The outlooks on the long-term deposit and debt ratings of all the Turkish banks rated by Moody's remain negative, in line with the negative outlook on the sovereign rating. The negative outlooks reflect the downside risks associated with a balance of payments crisis, which could lead to capital controls and restrictions on foreign currency outflows.

RATINGS RATIONALE

The rating action follows Moody's downgrade of the Government of Turkey's bond rating, which also resulted in the lowering of the ceilings for foreign currency deposits to Caa1 from B3, for foreign currency bonds to B2 from B1 and, for eight banks, a lower rating uplift from government support.

FOREIGN CURRENCY DEPOSIT RATINGS ARE CONSTRAINED BY THE FOREIGN CURRENCY DEPOSIT CEILING

In a related decision to the sovereign downgrade, Moody's lowered the long-term foreign currency deposit ceiling for Turkish banks to Caa1 from B3 on 11 September 2020. As a consequence, the long-term foreign currency deposit ratings of 12 Turkish banks are constrained at Caa1. These banks are: Akbank T.A.S. (Akbank), Alternatifbank A.S. (Alternatifbank), Denizbank A.S., HSBC Bank A.S. (Turkey), QNB Finansbank A.S. (QNB Finansbank),T.C. Ziraat Bankasi A.S. (Ziraat), Turk Ekonomi Bankasi A.S. (TEB), Turkiye Garanti Bankasi A.S. (Garanti BBVA), Turkiye Halk Bankasi A.S. (Halk Bank), Turkiye Is Bankasi A.S. (Isbank), Turkiye Vakiflar Bankasi T.A.O. (Vakifbank) and Yapi ve Kredi Bankasi A.S. (Yapi Kredi).

PROBABILITY OF GOVERNMENT SUPPORT IS UNCHANGED

Moody's has maintained its assumptions of government support unchanged for Turkish banks.

The long-term deposit and issuer ratings -- where applicable -- of eight banks benefit from uplift from government support, reflecting Moody's assumptions of very high or high probability of government support. These banks are Akbank, Export Credit Bank of Turkey A.S. (Turk Eximbank), Garanti BBVA, Halk Bank, Isbank, Vakifbank, Yapi Kredi, Ziraat.

The long-term CRR and CRA of Akbank, Garanti BBVA, Turk Eximbank, Vakifbank, Yapi Kredi and Ziraat now benefit from a one to two-notch uplift of government support, from two to three previously. This reflects an unchanged probability of government support and a narrower gap between the banks' BCA and Turkey's sovereign debt rating.

For the other banks, the rating agency continues to maintain a low probability of government support, which does not provide any rating uplift.

FOREIGN CURRENCY COUNTERPARTY RISK RATINGS (CRR) AND SENIOR UNSECURED RATING ARE IN SOME CASES CONSTRAINED BY THE FOREIGN CURRENCY BOND CEILING

Moody's lowered the long-term foreign currency bond ceiling for Turkish banks to B2 from B1 on 11 September 2020, in line with the sovereign downgrade. As a consequence, the long-term foreign currency CRR of Alternatifbank, QNB Finansbank and TEB and the senior unsecured rating of QNB Finansbank were downgraded and are constrained at B2.

VERY WEAK + MACRO PROFILE IS UNCHANGED

The BCAs and other ratings and assessments of Turkish banks are unaffected by this rating action because of the unchanged Macro Profile and Moody's affiliate support assumptions.

Moody's has maintained the Very Weak + Macro Profile it assigns to Turkish banks, reflecting the rating agency's unchanged view on the operating environment for banks. Despite a challenging economic environment and funding market conditions for Turkish banks, Moody's notes that Turkish banks' reliance on short term wholesale foreign funding has reduced moderately (USD44 billion at end-June 2020, from USD64 billion available at end-April 2019) while foreign currency liquidity has been maintained at broadly similar levels (USD90 billion at end-June 2020). As a result of this, Moody's reduced the negative adjustment it applies for Funding Conditions and maintained the Very Weak + Macro Profile. Moody's also notes that Turkish banks have continued to maintain access to the syndicated loans market throughout the coronavirus pandemic.

NEGATIVE OUTLOOK

All long-term deposit, senior and issuer ratings have a negative outlook, in line with the negative outlook on the sovereign rating. The outlook reflects the downside risks associated with the authorities' inadequate reaction function, which makes Turkey more likely to suffer a balance of payments crisis, which might lead to capital controls and restrictions on foreign currency outflows.

FACTORS THAT COULD LEAD TO AN UPGRADE OR DOWNGRADE OF THE RATINGS

An upgrade is unlikely, given the current negative outlook. The outlook could be changed to stable following a stabilisation of Turkey's sovereign outlook, an improvement of the operating environment, which would stabilise the banks' stock of problem loans and profitability, and a further structural reduction of the banks' reliance on foreign currency funding.

A downgrade could be driven by a downgrade of the sovereign rating, deterioration in Turkey's operating environment, a higher-than-expected deterioration of asset quality and profitability, or a material decline in capital ratios.

PRINCIPAL METHODOLOGY

The principal methodology used in these ratings was Banks Methodology published in November 2019 and available at https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1147865. Alternatively, please see the Rating Methodologies page on www.moodys.com for a copy of this methodology.

The local market analyst for QNB Finansbank A.S., Alternatifbank A.S. and Denizbank A.S. ratings is Nitish Bhojnagarwala, +971 (423) 795-63.

REGULATORY DISCLOSURES

The List of Affected Credit Ratings announced here are a mix of solicited and unsolicited credit ratings. Additionally, the List of Affected Credit Ratings includes additional disclosures that vary with regard to some of the ratings. Please click on this link https://www.moodys.com/viewresearchdoc.aspx?docid=PBC_ARFTL432558 for the List of Affected Credit Ratings. This list is an integral part of this Press Release and provides, for each of the credit ratings covered, Moody's disclosures on the following items:

âââââ¬Å¡¬¢ Endorsement

âââââ¬Å¡¬¢ Rating Solicitation

âââââ¬Å¡¬¢ Issuer Participation

âââââ¬Å¡¬¢ Participation: Access to Management

âââââ¬Å¡¬¢ Participation: Access to Internal Documents

âââââ¬Å¡¬¢ Disclosure to Rated Entity

âââââ¬Å¡¬¢ Lead Analyst

âââââ¬Å¡¬¢ Releasing Office

For further specification of Moody's key rating assumptions and sensitivity analysis, see the sections Methodology Assumptions and Sensitivity to Assumptions in the disclosure form. Moody's Rating Symbols and Definitions can be found at: https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_79004.

For ratings issued on a program, series, category/class of debt or security this announcement provides certain regulatory disclosures in relation to each rating of a subsequently issued bond or note of the same series, category/class of debt, security or pursuant to a program for which the ratings are derived exclusively from existing ratings in accordance with Moody's rating practices. For ratings issued on a support provider, this announcement provides certain regulatory disclosures in relation to the credit rating action on the support provider and in relation to each particular credit rating action for securities that derive their credit ratings from the support provider's credit rating. For provisional ratings, this announcement provides certain regulatory disclosures in relation to the provisional rating assigned, and in relation to a definitive rating that may be assigned subsequent to the final issuance of the debt, in each case where the transaction structure and terms have not changed prior to the assignment of the definitive rating in a manner that would have affected the rating. For further information please see the ratings tab on the issuer/entity page for the respective issuer on www.moodys.com.

For any affected securities or rated entities receiving direct credit support from the primary entity(ies) of this credit rating action, and whose ratings may change as a result of this credit rating action, the associated regulatory disclosures will be those of the guarantor entity. Exceptions to this approach exist for the following disclosures, if applicable to jurisdiction: Ancillary Services, Disclosure to rated entity, Disclosure from rated entity.

Regulatory disclosures contained in this press release apply to the credit rating and, if applicable, the related rating outlook or rating review.

Moody's general principles for assessing environmental, social and governance (ESG) risks in our credit analysis can be found at https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1133569.

The below contact information is provided for information purposes only. Please see the ratings tab of the issuer page at www.moodys.com, for each of the ratings covered, Moody's disclosures on the lead rating analyst and the Moody's legal entity that has issued the ratings.

The person who approved T.C. Ziraat Bankasi A.S., Turkiye Is Bankasi A.S., Turkiye Garanti Bankasi A.S., Akbank T.A.S. and Yapi ve Kredi Bankasi A.S. credit ratings is Henry MacNevin, Associate Managing Director, Financial Institutions Group, Journalists 44 20 7772 5456, Client Service 44 20 7772 5454. The person who approved Turkiye Halk Bankasi A.S., Turkiye Vakiflar Bankasi T.A.O., QNB Finansbank A.S., Denizbank A.S., Export Credit Bank of Turkey A.S., Turk Ekonomi Bankasi A.S., HSBC Bank A.S. (Turkey) and Alternatifbank A.S. credit ratings is Sean Marion, MD - Financial Institutions, Financial Institutions Group, Journalists 44 20 7772 5456, Client Service 44 20 7772 5454.

The relevant office for each credit rating is identified in "Debt/deal box" on the Ratings tab in the Debt/Deal List section of each issuer/entity page of the website.

Please see www.moodys.com for any updates on changes to the lead rating analyst and to the Moody's legal entity that has issued the rating.

Please see the ratings tab on the issuer/entity page on www.moodys.com for additional regulatory disclosures for each credit rating.

Carlo Gori

Vice President - Senior Analyst

Financial Institutions Group

Moody's Investors Service Ltd.

One Canada Square

Canary Wharf

London E14 5FA

United Kingdom

JOURNALISTS: 44 20 7772 5456

Client Service: 44 20 7772 5454

Sean Marion

MD - Financial Institutions

Financial Institutions Group

JOURNALISTS: 44 20 7772 5456

Client Service: 44 20 7772 5454

Releasing Office:

Moody's Investors Service Ltd.

One Canada Square

Canary Wharf

London E14 5FA

United Kingdom

JOURNALISTS: 44 20 7772 5456

Client Service: 44 20 7772 5454

En güçlü veya en zeki olan değil, DEĞİŞİME en açık olan türler hayatta kalır...Charles Darwin

https://twitter.com/r_x_p_u

Yer İmleri