https://tr.tradingview.com/v/AP50fvlX/

https://tr.tradingview.com/v/nMkQmtsu/

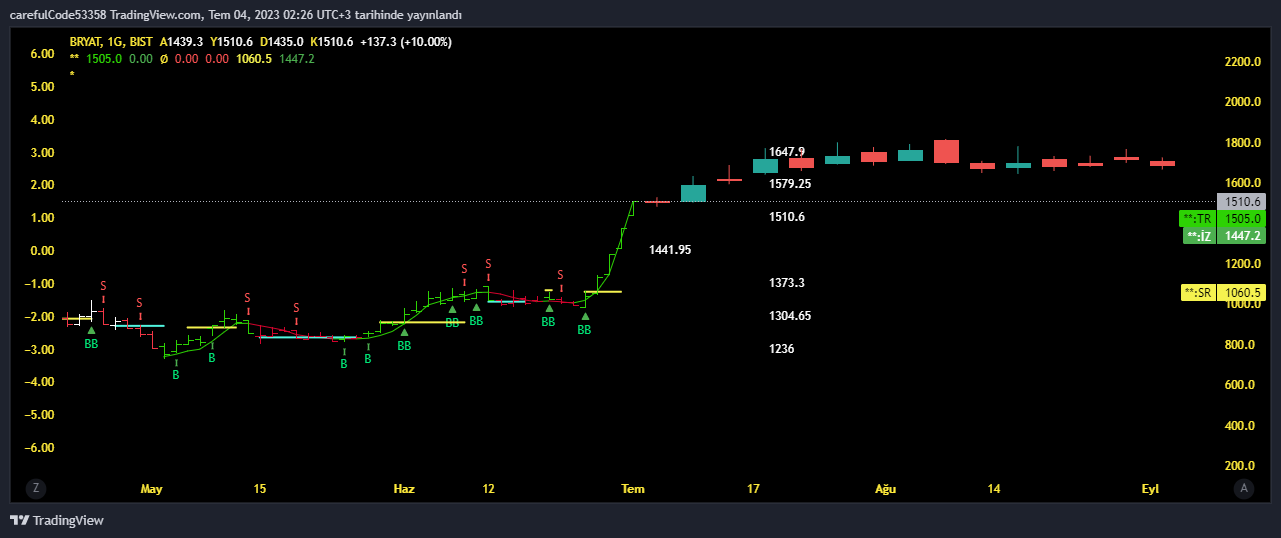

bu iki kodda...10 atr ile trend hesaplaması yapıyor....

https://www.tradingview.com/x/kRQCCI8t/

biri tableli...diğeri değil....

birinin üzerinden combine derleme ...

https://tr.tradingview.com/v/zFk8Fpr3/ bunu ekleyelim....

eklenmiş görüntü....https://www.tradingview.com/x/XT29Qy9k/

PHP Code:

//@version=5

indicator(title = "Farzan Paid Caliburn", precision=2, overlay = true)

bull1 = input(color.green, "Regular", group="Bullish Colors", inline="Bullish Colors")

bull2 = input(color.green, "Outside", group="Bullish Colors", inline="Bullish Colors")

mid1 = input(color.green, "Inside", group="Bullish Colors", inline="Bullish Colors")

bear1 = input(color.red, "Regular", group="Bearish Colors", inline="Bearish Colors")

bear2 = input(color.red, "Outside", group="Bearish Colors", inline="Bearish Colors")

mid2 = input(color.red, "Inside", group="Bearish Colors", inline="Bearish Colors")

inside = high < high[1] and low > low[1]

outside = high > high[1] and low < low[1]

bull = close > open

bear = open > close

candlecol = bull? (inside? mid1 : outside? bull2 : bull1) : bear? (inside? mid2 : outside? bear2 : bear1) : color.gray

bodycol = color.new(candlecol, 00)

//plotcandle(open,high,low,close, color = bodycol, bordercolor = candlecol, wickcolor = candlecol)

atrPeriod = input(10, "ATR Length")

factor = input.float(3.0, "Factor", step = 0.01)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

//fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

//fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

///////////////////////////////////

//@version=5

// Define input variables

emaLength = input.int(5, minval=1, title='EMA Length')

rsiLength = input.int(14, minval=1, title='RSI Length')

rsiOverbought = input(80, title='RSI Overbought Level')

rsiOversold = input(20, title='RSI Oversold Level')

start = input.float(title='Start', step=0.001, defval=0.05)

increment = input.float(title='Increment', step=0.001, defval=0.075)

maximum = input.float(title='Maximum', step=0.01, defval=0.35)

width = input.int(title='Point Width', minval=1, defval=2)

psar = ta.sar(start, increment, maximum)

dir = psar < close ? 1 : -1

psarColor = dir == 1 ? #3388bb : #fdcc02

//psarPlot = plot(psar, title='PSAR', style=plot.style_circles, linewidth=width, color=color.new(psarColor,0))

// Calculate EMA

emaValue = ta.ema(close, emaLength)

// Calculate RSI

rsiValue = ta.rsi(close, rsiLength)

// Define variables

var bool strongLongSignal = false

var bool strongShortSignal = false

highlightState = input(title='Highlight State ?', defval=true)

src = input(close, title='Source')

// Plotting

//plot(rsiValue, title='RSI', color=color.new(color.red, 0))

// Determine long and short signals based on conditions

strongLongSignal := high[1] < emaValue[1] and high > high[1] and rsiValue > rsiOversold and rsiValue > rsiValue[1]

longSignal = strongLongSignal

strongShortSignal := low[1] > emaValue[1] and low < low[1] and rsiValue < rsiOverbought and rsiValue < rsiValue[1]

shortSignal = strongShortSignal

// Buy Signal as per PSR

buySignalPSR = dir == 1 and dir[1] == -1

sellSignalPSR = dir == -1 and dir[1] == 1

//5-8-13 Signal

len5 = input.int(5, minval=1, title='5EMA')

out5 = ta.ema(src, len5)

emaValue5 = ta.ema(close, len5)

len8 = input.int(8, minval=1, title='8EMA')

out8 = ta.ema(src, len8)

emaValue8 = ta.ema(close, len8)

len13 = input.int(13, minval=1, title='13EMA')

out13 = ta.ema(src, len13)

emaValue13 = ta.ema(close, len13)

//Plot 5-8-13 EMA on Chart

//plot(out5, title='EMA5', color=color.new(color.red, 0), linewidth=1)

//plot(out8, title='EMA8', color=color.new(color.blue, 0), linewidth=1)

//plot(out13, title='EMA13', color=color.new(color.green, 0), linewidth=1)

// 5-8-13 EMA Buy Sell Signals Calculation

long5813 = ((ta.crossover(emaValue5, emaValue8) or emaValue5 > emaValue8) and

(ta.crossover(emaValue5, emaValue13) or emaValue5 > emaValue13) and

(buySignalPSR or dir == 1) and close > close[1] and

close > emaValue5 and close > emaValue8 and close > emaValue13)

short5813 = (((ta.crossunder(emaValue5, emaValue8) or emaValue5 < emaValue8) and

(ta.crossunder(emaValue5, emaValue13) or emaValue5 < emaValue13)) and

(sellSignalPSR or dir == -1) and close < close[1] and

close < emaValue5 and close < emaValue8 and close < emaValue13)

//Recheck Quick Buy and Sell Signals before plotting

if short5813

longSignal := false

if long5813

shortSignal := false

// Plot long and short signals

plotshape(not longSignal[1] ? longSignal : na, color=color.new(color.green, 0), style=shape.arrowup, text='QB', title='Quick Buy', location=location.belowbar)

plotshape(not long5813[1] ? long5813 : na, title='Strong Buy', color=color.new(color.green, 0), style=shape.triangleup, text='SB',location =location.belowbar)

plotshape(not shortSignal[1] ? shortSignal : na, color=color.new(color.red, 0), style=shape.arrowdown, text='QS',title='Quick Sell', location=location.abovebar, textcolor=color.new(color.red,0))

plotshape(not short5813[1] ? short5813 : na, title='Strong Sell', color=color.new(color.red, 0), style=shape.triangledown, text='SS', location=location.abovebar,textcolor=color.new(color.red,0))

midPricePlot = plot(ohlc4, title='PSAR Plot', display=display.none)

fillColor = highlightState ? dir == 1 ? color.green : color.red : na

//fill(midPricePlot, psarPlot, title='Trade State Filling', color=color.new(fillColor,90))

alertcondition(not longSignal[1] ? longSignal : na, 'Scalp Buy Signal', 'Scalp Buy/Long')

alertcondition(not long5813[1] ? long5813 : na, 'Strong Buy Signal', 'Buy/Long')

alertcondition(not shortSignal[1] ? shortSignal : na, 'Scalp Sell Signal', 'Scalp Sell/Short')

alertcondition(not short5813[1] ? short5813 : na, 'Strong Sell Signal', 'Sell/Short')

https://tr.tradingview.com/v/gThgCf69/ belki bu eklenebilir gibi....

https://www.tradingview.com/x/YFGR0Oec/

https://tr.tradingview.com/v/Cc7xGmYO/ bunda bar renklendirme olunca...

ve yaklaşık olarak supertrendle aynı değerler söz konusu olunca.....

böyle daha mantıklı gibi.....

PHP Code:

// This source code is subject to these terms:

// Attribution-NonCommercial 4.0 International (CC BY-NC 4.0)

// https://creativecommons.org/licenses/by-nc/4.0/

// You are free to Share, copy and redistribute. Adapt, transform and re-build on this script.

// Under the following terms: Non-commercial & Attribution.

// © gu5tavo71 (Gustavo Cardelle)

//@version=5

VERSION = 'v1.4.42'

indicator(

'Donchian Channels [Gu5]',

shorttitle = 'DC ' + VERSION,

overlay = true,

explicit_plot_zorder = true)

// Donchian Channels developed by Richard Donchian

// Actual Study Version: @gu5tavo71

// 2023.05.12

// Project #687

// This script reuses open source code from another authors:

// @PineCoders, Built-in Library, and Community Scripts

// Disclaimer: I am not a financial advisor.

// For purpose educate only. Use at your own risk.

//#region <constant_declarations> {

//<my colors>

C_GREEN = #006400 //Green

C_GREENLIGHT = #388e3c //Green Light

C_RED = #8B0000 //Red

C_REDLIGHT = #b71c1c //Red Light

//#endregion }

//#region <inputs> {

i_dcLen = input.int (20, 'Length' , minval = 1)

//Display

G_DISPLAY = 'Display'

i_showBasis = input.bool (true, '■ Basis On/Off' , group = G_DISPLAY)

i_alertOn = input.bool (false, '■ Alert On/Off' , group = G_DISPLAY)

i_showFill = input.bool (false, '■ Fill On/Off' , group = G_DISPLAY)

i_showBarCol = input.bool (true, '■ Bar Color On/Off' , group = G_DISPLAY)

i_showClose = input.bool (false, '■ Close Alert On/Off' , group = G_DISPLAY)

//#endregion }

//#region <calculations> {

//<set initial values>

condition = 0.0

dc = 0.0

dcDirCond = 0.0

dcTopDir = 0.0

dcBotDir = 0.0

dcTop = ta.highest(i_dcLen)

dcBot = ta.lowest (i_dcLen)

dcBasis = math.avg(dcTop, dcBot)

dc := dc[1] != 1 and dcTop > dcTop[1] ? 1 :

dc[1] != -1 and dcBot < dcBot[1] ? -1 : nz(dc[1])

dcDirUp = dcTop > dcTop[1]

dcDirDn = dcBot < dcBot[1]

dcDirZero = ta.crossunder(close, dcBasis) or ta.crossover(close, dcBasis)

dcDirCond := dcDirCond[1] != 1 and dcDirUp ? 1 :

dcDirCond[1] != -1 and dcDirDn ? -1 :

dcDirCond[1] != 0 and dcDirZero ? 0 : nz(dcDirCond[1])

dcDir = dcDirCond == 0 ? 0 :

dc == 1 ? 1 : -1

dcTopDir := dcTop < dcTop[1] ? 0 :

dcTop > dcTop[1] ? 1 : nz(dcTopDir[1])

dcBotDir := dcBot > dcBot[1] ? 0 :

dcBot < dcBot[1] ? -1 : nz(dcBotDir[1])

dcRange = dcTopDir == 0 and dcBotDir == 0

//<rules>

longErule = dcTop > dcTop[1]

shortErule = dcBot < dcBot[1]

longXrule = i_showClose ? ta.crossunder(close, dcBasis) : false

shortXrule = i_showClose ? ta.crossover (close, dcBasis) : false

//<conditions>

condition := condition[1] != 1 and longErule ? 1 :

condition[1] != -1 and shortErule ? -1 :

condition[1] != 0 and longXrule ? 0 :

condition[1] != 0 and shortXrule ? 0 : nz(condition[1])

longE = condition[1] != 1 and condition == 1

shortE = condition[1] != -1 and condition == -1

longX = condition[1] == 1 and longXrule

shortX = condition[1] == -1 and shortXrule

// <color>

c_range = dcRange or condition == 0

c_dcTop = c_range ? color.new(color.gray, 75) :

condition == 1 ? color.new(color.green, 0) :

condition == 0 ? color.new(color.orange, 0) :

dcRange ? color.new(color.orange, 0) :

color.new(color.gray, 75)

c_dcBot = c_range ? color.new(color.gray, 75) :

condition == -1 ? color.new(color.red, 0) :

condition == 0 ? color.new(color.orange, 0) :

color.new(color.gray, 75)

c_dcBasis = dcRange ? color.new(color.orange, 0) :

dc == 1 ? color.new(color.green, 25) :

dc == -1 ? color.new(color.red, 25) : na

c_dcFill = dcRange ? color.new(color.orange, 80) :

dc == 1 ? color.new(color.green, 80) :

dc == -1 ? color.new(color.red, 80) : na

c_barCol = c_range and open <= close ? color.new(color.orange, 0) :

c_range and open > close ? color.new(color.yellow, 0) :

condition == 1 and open <= close ? color.new(C_GREEN, 0) :

condition == 1 and open > close ? color.new(color.green, 0) :

condition == -1 and open >= close ? color.new(C_RED, 0) :

condition == -1 and open < close ? color.new(color.red, 0) :

color.new(color.gray, 0)

//#endregion }

//#region <visuals> {

plot(

i_showBasis ? dcBasis : na,

title = 'Basis',

linewidth = 2,

color = c_dcBasis)

barcolor(i_showBarCol ? c_barCol : na)

//#endregion }

///////////////////////////////////

//version=5

// Define input variables

emaLength = input.int(5, minval=1, title='EMA Length')

rsiLength = input.int(14, minval=1, title='RSI Length')

rsiOverbought = input(80, title='RSI Overbought Level')

rsiOversold = input(20, title='RSI Oversold Level')

start = input.float(title='Start', step=0.001, defval=0.05)

increment = input.float(title='Increment', step=0.001, defval=0.075)

maximum = input.float(title='Maximum', step=0.01, defval=0.35)

width = input.int(title='Point Width', minval=1, defval=2)

psar = ta.sar(start, increment, maximum)

dir = psar < close ? 1 : -1

psarColor = dir == 1 ? #3388bb : #fdcc02

//psarPlot = plot(psar, title='PSAR', style=plot.style_circles, linewidth=width, color=color.new(psarColor,0))

// Calculate EMA

emaValue = ta.ema(close, emaLength)

// Calculate RSI

rsiValue = ta.rsi(close, rsiLength)

// Define variables

var bool strongLongSignal = false

var bool strongShortSignal = false

highlightState = input(title='Highlight State ?', defval=true)

src = input(close, title='Source')

// Plotting

//plot(rsiValue, title='RSI', color=color.new(color.red, 0))

// Determine long and short signals based on conditions

strongLongSignal := high[1] < emaValue[1] and high > high[1] and rsiValue > rsiOversold and rsiValue > rsiValue[1]

longSignal = strongLongSignal

strongShortSignal := low[1] > emaValue[1] and low < low[1] and rsiValue < rsiOverbought and rsiValue < rsiValue[1]

shortSignal = strongShortSignal

// Buy Signal as per PSR

buySignalPSR = dir == 1 and dir[1] == -1

sellSignalPSR = dir == -1 and dir[1] == 1

//5-8-13 Signal

len5 = input.int(5, minval=1, title='5EMA')

out5 = ta.ema(src, len5)

emaValue5 = ta.ema(close, len5)

len8 = input.int(8, minval=1, title='8EMA')

out8 = ta.ema(src, len8)

emaValue8 = ta.ema(close, len8)

len13 = input.int(13, minval=1, title='13EMA')

out13 = ta.ema(src, len13)

emaValue13 = ta.ema(close, len13)

//Plot 5-8-13 EMA on Chart

//plot(out5, title='EMA5', color=color.new(color.red, 0), linewidth=1)

//plot(out8, title='EMA8', color=color.new(color.blue, 0), linewidth=1)

//plot(out13, title='EMA13', color=color.new(color.green, 0), linewidth=1)

// 5-8-13 EMA Buy Sell Signals Calculation

long5813 = ((ta.crossover(emaValue5, emaValue8) or emaValue5 > emaValue8) and

(ta.crossover(emaValue5, emaValue13) or emaValue5 > emaValue13) and

(buySignalPSR or dir == 1) and close > close[1] and

close > emaValue5 and close > emaValue8 and close > emaValue13)

short5813 = (((ta.crossunder(emaValue5, emaValue8) or emaValue5 < emaValue8) and

(ta.crossunder(emaValue5, emaValue13) or emaValue5 < emaValue13)) and

(sellSignalPSR or dir == -1) and close < close[1] and

close < emaValue5 and close < emaValue8 and close < emaValue13)

//Recheck Quick Buy and Sell Signals before plotting

if short5813

longSignal := false

if long5813

shortSignal := false

// Plot long and short signals

plotshape(not longSignal[1] ? longSignal : na, color=color.new(color.green, 0), style=shape.arrowup, text='QB', title='Quick Buy', location=location.belowbar)

plotshape(not long5813[1] ? long5813 : na, title='Strong Buy', color=color.new(color.green, 0), style=shape.triangleup, text='SB',location =location.belowbar)

plotshape(not shortSignal[1] ? shortSignal : na, color=color.new(color.red, 0), style=shape.arrowdown, text='QS',title='Quick Sell', location=location.abovebar, textcolor=color.new(color.red,0))

plotshape(not short5813[1] ? short5813 : na, title='Strong Sell', color=color.new(color.red, 0), style=shape.triangledown, text='SS', location=location.abovebar,textcolor=color.new(color.red,0))

midPricePlot = plot(ohlc4, title='PSAR Plot', display=display.none)

fillColor = highlightState ? dir == 1 ? color.green : color.red : na

//fill(midPricePlot, psarPlot, title='Trade State Filling', color=color.new(fillColor,90))

alertcondition(not longSignal[1] ? longSignal : na, 'Scalp Buy Signal', 'Scalp Buy/Long')

alertcondition(not long5813[1] ? long5813 : na, 'Strong Buy Signal', 'Buy/Long')

alertcondition(not shortSignal[1] ? shortSignal : na, 'Scalp Sell Signal', 'Scalp Sell/Short')

alertcondition(not short5813[1] ? short5813 : na, 'Strong Sell Signal', 'Sell/Short')

//////////////////////////

https://www.tradingview.com/x/gddG1fOG/

https://tr.tradingview.com/v/NKpGkblS/

bu eklenince görüntü.... https://www.tradingview.com/x/doQXSm7b/

PHP Code:

// This source code is subject to these terms:

// Attribution-NonCommercial 4.0 International (CC BY-NC 4.0)

// https://creativecommons.org/licenses/by-nc/4.0/

// You are free to Share, copy and redistribute. Adapt, transform and re-build on this script.

// Under the following terms: Non-commercial & Attribution.

// © gu5tavo71 (Gustavo Cardelle)

//@version=5

VERSION = 'v1.4.42'

indicator(

'Donchian Channels [Gu5]',

shorttitle = 'DC ' + VERSION,

overlay = true,

explicit_plot_zorder = true,

max_bars_back = 5000)

// Donchian Channels developed by Richard Donchian

// Actual Study Version: @gu5tavo71

// 2023.05.12

// Project #687

// This script reuses open source code from another authors:

// @PineCoders, Built-in Library, and Community Scripts

// Disclaimer: I am not a financial advisor.

// For purpose educate only. Use at your own risk.

//#region <constant_declarations> {

//<my colors>

C_GREEN = #006400 //Green

C_GREENLIGHT = #388e3c //Green Light

C_RED = #8B0000 //Red

C_REDLIGHT = #b71c1c //Red Light

//#endregion }

//#region <inputs> {

i_dcLen = input.int (20, 'Length' , minval = 1)

//Display

G_DISPLAY = 'Display'

i_showBasis = input.bool (true, '■ Basis On/Off' , group = G_DISPLAY)

i_alertOn = input.bool (false, '■ Alert On/Off' , group = G_DISPLAY)

i_showFill = input.bool (false, '■ Fill On/Off' , group = G_DISPLAY)

i_showBarCol = input.bool (true, '■ Bar Color On/Off' , group = G_DISPLAY)

i_showClose = input.bool (false, '■ Close Alert On/Off' , group = G_DISPLAY)

//#endregion }

//#region <calculations> {

//<set initial values>

condition = 0.0

dc = 0.0

dcDirCond = 0.0

dcTopDir = 0.0

dcBotDir = 0.0

dcTop = ta.highest(i_dcLen)

dcBot = ta.lowest (i_dcLen)

dcBasis = math.avg(dcTop, dcBot)

dc := dc[1] != 1 and dcTop > dcTop[1] ? 1 :

dc[1] != -1 and dcBot < dcBot[1] ? -1 : nz(dc[1])

dcDirUp = dcTop > dcTop[1]

dcDirDn = dcBot < dcBot[1]

dcDirZero = ta.crossunder(close, dcBasis) or ta.crossover(close, dcBasis)

dcDirCond := dcDirCond[1] != 1 and dcDirUp ? 1 :

dcDirCond[1] != -1 and dcDirDn ? -1 :

dcDirCond[1] != 0 and dcDirZero ? 0 : nz(dcDirCond[1])

dcDir = dcDirCond == 0 ? 0 :

dc == 1 ? 1 : -1

dcTopDir := dcTop < dcTop[1] ? 0 :

dcTop > dcTop[1] ? 1 : nz(dcTopDir[1])

dcBotDir := dcBot > dcBot[1] ? 0 :

dcBot < dcBot[1] ? -1 : nz(dcBotDir[1])

dcRange = dcTopDir == 0 and dcBotDir == 0

//<rules>

longErule = dcTop > dcTop[1]

shortErule = dcBot < dcBot[1]

longXrule = i_showClose ? ta.crossunder(close, dcBasis) : false

shortXrule = i_showClose ? ta.crossover (close, dcBasis) : false

//<conditions>

condition := condition[1] != 1 and longErule ? 1 :

condition[1] != -1 and shortErule ? -1 :

condition[1] != 0 and longXrule ? 0 :

condition[1] != 0 and shortXrule ? 0 : nz(condition[1])

longE = condition[1] != 1 and condition == 1

shortE = condition[1] != -1 and condition == -1

longX = condition[1] == 1 and longXrule

shortX = condition[1] == -1 and shortXrule

// <color>

c_range = dcRange or condition == 0

c_dcTop = c_range ? color.new(color.gray, 75) :

condition == 1 ? color.new(color.green, 0) :

condition == 0 ? color.new(color.orange, 0) :

dcRange ? color.new(color.orange, 0) :

color.new(color.gray, 75)

c_dcBot = c_range ? color.new(color.gray, 75) :

condition == -1 ? color.new(color.red, 0) :

condition == 0 ? color.new(color.orange, 0) :

color.new(color.gray, 75)

c_dcBasis = dcRange ? color.new(color.orange, 0) :

dc == 1 ? color.new(color.green, 25) :

dc == -1 ? color.new(color.red, 25) : na

c_dcFill = dcRange ? color.new(color.orange, 80) :

dc == 1 ? color.new(color.green, 80) :

dc == -1 ? color.new(color.red, 80) : na

c_barCol = c_range and open <= close ? color.new(color.orange, 0) :

c_range and open > close ? color.new(color.yellow, 0) :

condition == 1 and open <= close ? color.new(C_GREEN, 0) :

condition == 1 and open > close ? color.new(color.green, 0) :

condition == -1 and open >= close ? color.new(C_RED, 0) :

condition == -1 and open < close ? color.new(color.red, 0) :

color.new(color.gray, 0)

//#endregion }

//#region <visuals> {

plot(

i_showBasis ? dcBasis : na,

title = 'Basis',

linewidth = 2,

color = c_dcBasis)

barcolor(i_showBarCol ? c_barCol : na)

//#endregion }

///////////////////////////////////

//version=5

// Define input variables

emaLength = input.int(5, minval=1, title='EMA Length')

rsiLength = input.int(14, minval=1, title='RSI Length')

rsiOverbought = input(80, title='RSI Overbought Level')

rsiOversold = input(20, title='RSI Oversold Level')

start = input.float(title='Start', step=0.001, defval=0.05)

increment = input.float(title='Increment', step=0.001, defval=0.075)

maximum = input.float(title='Maximum', step=0.01, defval=0.35)

width = input.int(title='Point Width', minval=1, defval=2)

psar = ta.sar(start, increment, maximum)

dir = psar < close ? 1 : -1

psarColor = dir == 1 ? #3388bb : #fdcc02

//psarPlot = plot(psar, title='PSAR', style=plot.style_circles, linewidth=width, color=color.new(psarColor,0))

// Calculate EMA

emaValue = ta.ema(close, emaLength)

// Calculate RSI

rsiValue = ta.rsi(close, rsiLength)

// Define variables

var bool strongLongSignal = false

var bool strongShortSignal = false

highlightState = input(title='Highlight State ?', defval=true)

src = input(close, title='Source')

// Plotting

//plot(rsiValue, title='RSI', color=color.new(color.red, 0))

// Determine long and short signals based on conditions

strongLongSignal := high[1] < emaValue[1] and high > high[1] and rsiValue > rsiOversold and rsiValue > rsiValue[1]

longSignal = strongLongSignal

strongShortSignal := low[1] > emaValue[1] and low < low[1] and rsiValue < rsiOverbought and rsiValue < rsiValue[1]

shortSignal = strongShortSignal

// Buy Signal as per PSR

buySignalPSR = dir == 1 and dir[1] == -1

sellSignalPSR = dir == -1 and dir[1] == 1

//5-8-13 Signal

len5 = input.int(5, minval=1, title='5EMA')

out5 = ta.ema(src, len5)

emaValue5 = ta.ema(close, len5)

len8 = input.int(8, minval=1, title='8EMA')

out8 = ta.ema(src, len8)

emaValue8 = ta.ema(close, len8)

len13 = input.int(13, minval=1, title='13EMA')

out13 = ta.ema(src, len13)

emaValue13 = ta.ema(close, len13)

//Plot 5-8-13 EMA on Chart

//plot(out5, title='EMA5', color=color.new(color.red, 0), linewidth=1)

//plot(out8, title='EMA8', color=color.new(color.blue, 0), linewidth=1)

//plot(out13, title='EMA13', color=color.new(color.green, 0), linewidth=1)

// 5-8-13 EMA Buy Sell Signals Calculation

long5813 = ((ta.crossover(emaValue5, emaValue8) or emaValue5 > emaValue8) and

(ta.crossover(emaValue5, emaValue13) or emaValue5 > emaValue13) and

(buySignalPSR or dir == 1) and close > close[1] and

close > emaValue5 and close > emaValue8 and close > emaValue13)

short5813 = (((ta.crossunder(emaValue5, emaValue8) or emaValue5 < emaValue8) and

(ta.crossunder(emaValue5, emaValue13) or emaValue5 < emaValue13)) and

(sellSignalPSR or dir == -1) and close < close[1] and

close < emaValue5 and close < emaValue8 and close < emaValue13)

//Recheck Quick Buy and Sell Signals before plotting

if short5813

longSignal := false

if long5813

shortSignal := false

// Plot long and short signals

plotshape(not longSignal[1] ? longSignal : na, color=color.new(color.green, 0), style=shape.arrowup, text='QB', title='Quick Buy', location=location.belowbar)

plotshape(not long5813[1] ? long5813 : na, title='Strong Buy', color=color.new(color.green, 0), style=shape.triangleup, text='SB',location =location.belowbar)

plotshape(not shortSignal[1] ? shortSignal : na, color=color.new(color.red, 0), style=shape.arrowdown, text='QS',title='Quick Sell', location=location.abovebar, textcolor=color.new(color.red,0))

plotshape(not short5813[1] ? short5813 : na, title='Strong Sell', color=color.new(color.red, 0), style=shape.triangledown, text='SS', location=location.abovebar,textcolor=color.new(color.red,0))

midPricePlot = plot(ohlc4, title='PSAR Plot', display=display.none)

fillColor = highlightState ? dir == 1 ? color.green : color.red : na

//fill(midPricePlot, psarPlot, title='Trade State Filling', color=color.new(fillColor,90))

alertcondition(not longSignal[1] ? longSignal : na, 'Scalp Buy Signal', 'Scalp Buy/Long')

alertcondition(not long5813[1] ? long5813 : na, 'Strong Buy Signal', 'Buy/Long')

alertcondition(not shortSignal[1] ? shortSignal : na, 'Scalp Sell Signal', 'Scalp Sell/Short')

alertcondition(not short5813[1] ? short5813 : na, 'Strong Sell Signal', 'Sell/Short')

//////////////////////////

//@version=5

// ----- * ----- // ----- * ----- // ----- * ----- // ----- * ----- P A R A M E T E R S - S E T U P ----- * ----- // ----- * ----- // ----- * ----- // ----- * -----

// EMA & ATR

float ema_16 = math.round_to_mintick(ta.ema(close, 16))

float ema_64 = math.round_to_mintick(ta.ema(close, 64))

float ema_256 = math.round_to_mintick(ta.ema(close, 256))

float atr = ta.atr(16)

bool golden_cross = ta.crossover(ema_64, ema_256)

bool death_cross = ta.crossunder(ema_64, ema_256)

bool bullish_64 = ema_16 > ema_64

bool bearish_64 = ema_16 < ema_64

bool bullish_256 = ema_64 > ema_256

bool bearish_256 = ema_64 < ema_256

color trend_color_64 = bullish_64 ? color.new(#00E676, 50) : color.new(#FF5252, 50)

color trend_color_256 = bullish_256 ? color.new(#00E676, 10) : color.new(#FF5252, 10)

// ----- * ----- // ----- * ----- // ----- * ----- // ----- * ----- T R A D I N G - S E T U P ----- * ----- // ----- * ----- // ----- * ----- // ----- * -----

// Accumulation zone

float upper_atr = ema_16 + atr

float lower_atr = ema_16 - atr

bool in_trend = (hl2 > upper_atr or hl2 < lower_atr) or (ema_64 > upper_atr or ema_64 < lower_atr)

ub = plot(in_trend ? na : upper_atr, "Upper Band", color = color.new(#FF5252, 100), editable = false, offset = 0, display = display.none)

lb = plot(in_trend ? na : lower_atr, "Lower Band", color = color.new(#FF5252, 100), editable = false, offset = 0, display = display.none)

//fill(ub, lb, title = "Accumulation Zone", color = color.new(#FF5252, 25), display = display.none)

// Long & short conditions

bool long_conditions = bullish_64 and bullish_256 //and in_trend (to be developed)

bool short_conditions = bearish_64 and bearish_256 //and in_trend (to be developed)

bool trigger_l_64 = (ta.crossunder(low, ema_64) or open < ema_64) and (close > ema_64) and long_conditions

bool trigger_l_256 = (ta.crossunder(low, ema_256) or low == ema_256 or open < ema_256) and (close > ema_256) and bullish_256

bool trigger_s_64 = (ta.crossover(high, ema_64) or high == ema_64) and (close < ema_64) and short_conditions

bool trigger_s_256 = (ta.crossover(high, ema_256) or high == ema_256) and (close < ema_256) and bearish_256

// Execution check long

x = ta.barssince(golden_cross)

bool executed_l_64 = false

i = 1

while not executed_l_64 and i < x

if (trigger_l_64[i]) or (close[i] < ema_64)

executed_l_64 := true

else

i := i + 1

bool executed_l_256 = false

j = 1

while not executed_l_256 and j < x

if trigger_l_256[j]

executed_l_256 := true

else

j := j + 1

// Execution check short

y = ta.barssince(death_cross)

bool executed_s_64 = false

k = 1

while not executed_s_64 and k < y

if (trigger_s_64[k]) or (close[k] > ema_64)

executed_s_64 := true

else

k := k + 1

bool executed_s_256 = false

l = 1

while not executed_s_256 and l < y

if trigger_s_256[l]

executed_s_256 := true

else

l := l + 1

// Position opening & SL

bool long_64 = trigger_l_64 and (executed_l_64 == false)

bool long_256 = trigger_l_256 and (executed_l_256 == false)

bool short_64 = trigger_s_64 and (executed_s_64 == false)

bool short_256 = trigger_s_256 and (executed_s_256 == false)

float entry = close[1]

float sl_long = low[1] * .995

float sl_short = high[1] * 1.005

//float lowest_low = ta.lowest(math.max(nz(x), 1)) // Support to be developed

//float highest_high = ta.highest(math.max(nz(y), 1)) // Resistance to be developed

// ----- * ----- // ----- * ----- // ----- * ----- // ----- * ----- P L O T ----- * ----- // ----- * ----- // ----- * ----- // ----- * -----

float ema_64_pips = math.round_to_mintick(math.abs(close - ema_64[1]))

float ema_64_percent = math.round_to_mintick(close / ema_64[1] - 1) * 100

float ema_256_pips = math.round_to_mintick(math.abs(close - ema_256[1]))

float ema_256_percent = math.round_to_mintick(close / ema_256[1] - 1) * 100

//plot(ema_16, "EMA 16", color = color.new(#FF9800, 0), linewidth = 1, display = display.none)

plot(ema_64, "EMA 64", color = trend_color_64, linewidth = 2, display = display.none)

//plot(ema_256, "EMA 256", color = trend_color_256, linewidth = 3, display = display.all)

https://tr.tradingview.com/v/iwEyBE2d/

görüntü.... https://www.tradingview.com/x/BDyCfDDw/

PHP Code:

// This source code is subject to these terms:

// Attribution-NonCommercial 4.0 International (CC BY-NC 4.0)

// https://creativecommons.org/licenses/by-nc/4.0/

// You are free to Share, copy and redistribute. Adapt, transform and re-build on this script.

// Under the following terms: Non-commercial & Attribution.

// © gu5tavo71 (Gustavo Cardelle)

//@version=5

VERSION = 'v1.4.42'

indicator(

'Donchian Channels [Gu5]',

shorttitle = 'DC ' + VERSION,

overlay = true,

explicit_plot_zorder = true,

max_bars_back = 5000)

// Donchian Channels developed by Richard Donchian

// Actual Study Version: @gu5tavo71

// 2023.05.12

// Project #687

// This script reuses open source code from another authors:

// @PineCoders, Built-in Library, and Community Scripts

// Disclaimer: I am not a financial advisor.

// For purpose educate only. Use at your own risk.

//#region <constant_declarations> {

//<my colors>

C_GREEN = #006400 //Green

C_GREENLIGHT = #388e3c //Green Light

C_RED = #8B0000 //Red

C_REDLIGHT = #b71c1c //Red Light

//#endregion }

//#region <inputs> {

i_dcLen = input.int (20, 'Length' , minval = 1)

//Display

G_DISPLAY = 'Display'

i_showBasis = input.bool (true, '■ Basis On/Off' , group = G_DISPLAY)

i_alertOn = input.bool (false, '■ Alert On/Off' , group = G_DISPLAY)

i_showFill = input.bool (false, '■ Fill On/Off' , group = G_DISPLAY)

i_showBarCol = input.bool (true, '■ Bar Color On/Off' , group = G_DISPLAY)

i_showClose = input.bool (false, '■ Close Alert On/Off' , group = G_DISPLAY)

//#endregion }

//#region <calculations> {

//<set initial values>

condition = 0.0

dc = 0.0

dcDirCond = 0.0

dcTopDir = 0.0

dcBotDir = 0.0

dcTop = ta.highest(i_dcLen)

dcBot = ta.lowest (i_dcLen)

dcBasis = math.avg(dcTop, dcBot)

dc := dc[1] != 1 and dcTop > dcTop[1] ? 1 :

dc[1] != -1 and dcBot < dcBot[1] ? -1 : nz(dc[1])

dcDirUp = dcTop > dcTop[1]

dcDirDn = dcBot < dcBot[1]

dcDirZero = ta.crossunder(close, dcBasis) or ta.crossover(close, dcBasis)

dcDirCond := dcDirCond[1] != 1 and dcDirUp ? 1 :

dcDirCond[1] != -1 and dcDirDn ? -1 :

dcDirCond[1] != 0 and dcDirZero ? 0 : nz(dcDirCond[1])

dcDir = dcDirCond == 0 ? 0 :

dc == 1 ? 1 : -1

dcTopDir := dcTop < dcTop[1] ? 0 :

dcTop > dcTop[1] ? 1 : nz(dcTopDir[1])

dcBotDir := dcBot > dcBot[1] ? 0 :

dcBot < dcBot[1] ? -1 : nz(dcBotDir[1])

dcRange = dcTopDir == 0 and dcBotDir == 0

//<rules>

longErule = dcTop > dcTop[1]

shortErule = dcBot < dcBot[1]

longXrule = i_showClose ? ta.crossunder(close, dcBasis) : false

shortXrule = i_showClose ? ta.crossover (close, dcBasis) : false

//<conditions>

condition := condition[1] != 1 and longErule ? 1 :

condition[1] != -1 and shortErule ? -1 :

condition[1] != 0 and longXrule ? 0 :

condition[1] != 0 and shortXrule ? 0 : nz(condition[1])

longE = condition[1] != 1 and condition == 1

shortE = condition[1] != -1 and condition == -1

longX = condition[1] == 1 and longXrule

shortX = condition[1] == -1 and shortXrule

// <color>

c_range = dcRange or condition == 0

c_dcTop = c_range ? color.new(color.gray, 75) :

condition == 1 ? color.new(color.green, 0) :

condition == 0 ? color.new(color.orange, 0) :

dcRange ? color.new(color.orange, 0) :

color.new(color.gray, 75)

c_dcBot = c_range ? color.new(color.gray, 75) :

condition == -1 ? color.new(color.red, 0) :

condition == 0 ? color.new(color.orange, 0) :

color.new(color.gray, 75)

c_dcBasis = dcRange ? color.new(color.orange, 0) :

dc == 1 ? color.new(color.green, 25) :

dc == -1 ? color.new(color.red, 25) : na

c_dcFill = dcRange ? color.new(color.orange, 80) :

dc == 1 ? color.new(color.green, 80) :

dc == -1 ? color.new(color.red, 80) : na

c_barCol = c_range and open <= close ? color.new(color.orange, 0) :

c_range and open > close ? color.new(color.yellow, 0) :

condition == 1 and open <= close ? color.new(C_GREEN, 0) :

condition == 1 and open > close ? color.new(color.green, 0) :

condition == -1 and open >= close ? color.new(C_RED, 0) :

condition == -1 and open < close ? color.new(color.red, 0) :

color.new(color.gray, 0)

//#endregion }

//#region <visuals> {

plot(

i_showBasis ? dcBasis : na,

title = 'Basis',

linewidth = 2,

color = c_dcBasis)

barcolor(i_showBarCol ? c_barCol : na)

//#endregion }

///////////////////////////////////

//version=5

// Define input variables

emaLength = input.int(5, minval=1, title='EMA Length')

rsiLength = input.int(14, minval=1, title='RSI Length')

rsiOverbought = input(80, title='RSI Overbought Level')

rsiOversold = input(20, title='RSI Oversold Level')

start = input.float(title='Start', step=0.001, defval=0.05)

increment = input.float(title='Increment', step=0.001, defval=0.075)

maximum = input.float(title='Maximum', step=0.01, defval=0.35)

width = input.int(title='Point Width', minval=1, defval=2)

psar = ta.sar(start, increment, maximum)

dir = psar < close ? 1 : -1

psarColor = dir == 1 ? #3388bb : #fdcc02

//psarPlot = plot(psar, title='PSAR', style=plot.style_circles, linewidth=width, color=color.new(psarColor,0))

// Calculate EMA

emaValue = ta.ema(close, emaLength)

// Calculate RSI

rsiValue = ta.rsi(close, rsiLength)

// Define variables

var bool strongLongSignal = false

var bool strongShortSignal = false

highlightState = input(title='Highlight State ?', defval=true)

src = input(close, title='Source')

// Plotting

//plot(rsiValue, title='RSI', color=color.new(color.red, 0))

// Determine long and short signals based on conditions

strongLongSignal := high[1] < emaValue[1] and high > high[1] and rsiValue > rsiOversold and rsiValue > rsiValue[1]

longSignal = strongLongSignal

strongShortSignal := low[1] > emaValue[1] and low < low[1] and rsiValue < rsiOverbought and rsiValue < rsiValue[1]

shortSignal = strongShortSignal

// Buy Signal as per PSR

buySignalPSR = dir == 1 and dir[1] == -1

sellSignalPSR = dir == -1 and dir[1] == 1

//5-8-13 Signal

len5 = input.int(5, minval=1, title='5EMA')

out5 = ta.ema(src, len5)

emaValue5 = ta.ema(close, len5)

len8 = input.int(8, minval=1, title='8EMA')

out8 = ta.ema(src, len8)

emaValue8 = ta.ema(close, len8)

len13 = input.int(13, minval=1, title='13EMA')

out13 = ta.ema(src, len13)

emaValue13 = ta.ema(close, len13)

//Plot 5-8-13 EMA on Chart

//plot(out5, title='EMA5', color=color.new(color.red, 0), linewidth=1)

//plot(out8, title='EMA8', color=color.new(color.blue, 0), linewidth=1)

//plot(out13, title='EMA13', color=color.new(color.green, 0), linewidth=1)

// 5-8-13 EMA Buy Sell Signals Calculation

long5813 = ((ta.crossover(emaValue5, emaValue8) or emaValue5 > emaValue8) and

(ta.crossover(emaValue5, emaValue13) or emaValue5 > emaValue13) and

(buySignalPSR or dir == 1) and close > close[1] and

close > emaValue5 and close > emaValue8 and close > emaValue13)

short5813 = (((ta.crossunder(emaValue5, emaValue8) or emaValue5 < emaValue8) and

(ta.crossunder(emaValue5, emaValue13) or emaValue5 < emaValue13)) and

(sellSignalPSR or dir == -1) and close < close[1] and

close < emaValue5 and close < emaValue8 and close < emaValue13)

//Recheck Quick Buy and Sell Signals before plotting

if short5813

longSignal := false

if long5813

shortSignal := false

// Plot long and short signals

//plotshape(not longSignal[1] ? longSignal : na, color=color.new(color.green, 0), style=shape.arrowup, text='QB', title='Quick Buy', location=location.belowbar)

//plotshape(not long5813[1] ? long5813 : na, title='Strong Buy', color=color.new(color.green, 0), style=shape.triangleup, text='SB',location =location.belowbar)

//plotshape(not shortSignal[1] ? shortSignal : na, color=color.new(color.red, 0), style=shape.arrowdown, text='QS',title='Quick Sell', location=location.abovebar, textcolor=color.new(color.red,0))

//plotshape(not short5813[1] ? short5813 : na, title='Strong Sell', color=color.new(color.red, 0), style=shape.triangledown, text='SS', location=location.abovebar,textcolor=color.new(color.red,0))

midPricePlot = plot(ohlc4, title='PSAR Plot', display=display.none)

fillColor = highlightState ? dir == 1 ? color.green : color.red : na

//fill(midPricePlot, psarPlot, title='Trade State Filling', color=color.new(fillColor,90))

alertcondition(not longSignal[1] ? longSignal : na, 'Scalp Buy Signal', 'Scalp Buy/Long')

alertcondition(not long5813[1] ? long5813 : na, 'Strong Buy Signal', 'Buy/Long')

alertcondition(not shortSignal[1] ? shortSignal : na, 'Scalp Sell Signal', 'Scalp Sell/Short')

alertcondition(not short5813[1] ? short5813 : na, 'Strong Sell Signal', 'Sell/Short')

//////////////////////////

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ChartPrime

//@version=5

// Custom cosh function

cosh(float x) =>

(math.exp(x) + math.exp(-x)) / 2

// Custom acosh function

acosh(float x) =>

x < 1 ? na : math.log(x + math.sqrt(x * x - 1))

// Custom sinh function

sinh(float x) =>

(math.exp(x) - math.exp(-x)) / 2

// Custom asinh function

asinh(float x) =>

math.log(x + math.sqrt(x * x + 1))

// Custom inverse tangent function

atan(float x) =>

math.pi / 2 - math.atan(1 / x)

// Chebyshev Type I Moving Average

chebyshevI(float src, int len, float ripple) =>

a = 0.

b = 0.

g = 0.

chebyshev = 0.

a := cosh(1 / len * acosh(1 / (1 - ripple)))

b := sinh(1 / len * asinh(1 / ripple))

g := (a - b) / (a + b)

chebyshev := (1 - g) * src + g * nz(chebyshev[1])

chebyshev

bool_to_float(bool source) =>

source ? 1 : 0

ema(source)=>

var float ema = 0.0

var int count = 0

count := nz(count[1]) + 1

ema := (1.0 - 2.0 / (count + 1.0)) * nz(ema[1]) + 2.0 / (count + 1.0) * source

ema

atan2(y, x) =>

var float angle = 0.0

if x > 0

angle := math.atan(y / x)

else

if x < 0 and y >= 0

angle := math.atan(y / x) + math.pi

else

if x < 0 and y < 0

angle := math.atan(y / x) - math.pi

else

if x == 0 and y > 0

angle := math.pi / 2

else

if x == 0 and y < 0

angle := -math.pi / 2

angle

degrees(float source) =>

source * 180 / math.pi

tra()=>

atr = ema(ta.tr)

slope = (close - close[10]) / (atr * 10)

angle_rad = atan2(slope, 1)

degrees = degrees(angle_rad)

source = ta.sma((degrees > 0 ? high : low), 2)

mats(source, length) =>

smooth = 0.

higher_high = math.max(math.sign(ta.change(ta.highest(length))), 0)

lower_low = math.max(math.sign(ta.change(ta.lowest(length)) * -1), 0)

time_constant = math.pow(ta.sma(bool_to_float(higher_high or lower_low), length), 2)

smooth := nz(smooth[1] + time_constant * (source - smooth[1]), source)

wilders_period = length * 4 - 1

atr = math.abs(nz(smooth[1]) - smooth)

ma_atr = ta.ema(atr, wilders_period)

delta_fast_atr = ta.ema(ma_atr, wilders_period) * length * 0.4

result = 0.0

if smooth > nz(result[1])

if smooth - delta_fast_atr < result[1]

result := result[1]

else

result := smooth - delta_fast_atr

else

if smooth + delta_fast_atr > result[1]

result := result[1]

else

result := smooth + delta_fast_atr

// Return

result

length = input.int(20, "Length", 2)

up_color = input.color(color.blue, "", inline = "color")

down_color = input.color(color.orange, "", inline = "color")

enable_glow = input.bool(true, "Enable Glow", inline = "color")

mats = mats(tra(), length)

atr = ta.atr(length)

colour = ta.sma(close, 2) > mats ? up_color : down_color

atr_10 = ema(ta.tr) / 2

alpha = color.new(color.black, 100)

max = mats + atr_10

min = mats - atr_10

center = plot(mats, "Moving Average Trend Sniper", colour, editable = true)

//plot(mats, "Moving Average Trend Sniper", color.new(colour, 70), 2, editable = true)

//plot(mats, "Moving Average Trend Sniper", color.new(colour, 80), 3, editable = true)

//plot(mats, "Moving Average Trend Sniper", color.new(colour, 90), 4, editable = true)

//top = plot(enable_glow ? max : na, "Moving Average Trend Sniper", alpha)

//bottom = plot(enable_glow ? min : na, "Moving Average Trend Sniper", alpha)

//fill(top, center, top_value = max, bottom_value = mats, bottom_color = color.new(colour, 75), top_color = alpha, editable = true)

//fill(center, bottom, top_value = mats, bottom_value = min, bottom_color = alpha, top_color = color.new(colour, 75), editable = true)

https://tr.tradingview.com/v/pFV6T1r2/

görüntü.... https://www.tradingview.com/x/xiNNJnwC/

PHP Code:

// This source code is subject to these terms:

// Attribution-NonCommercial 4.0 International (CC BY-NC 4.0)

// https://creativecommons.org/licenses/by-nc/4.0/

// You are free to Share, copy and redistribute. Adapt, transform and re-build on this script.

// Under the following terms: Non-commercial & Attribution.

// © gu5tavo71 (Gustavo Cardelle)

//@version=5

VERSION = 'v1.4.42'

indicator(

'Donchian Channels [Gu5]',

shorttitle = 'DC ' + VERSION,

overlay = true,

explicit_plot_zorder = true,

max_bars_back = 5000)

// Donchian Channels developed by Richard Donchian

// Actual Study Version: @gu5tavo71

// 2023.05.12

// Project #687

// This script reuses open source code from another authors:

// @PineCoders, Built-in Library, and Community Scripts

// Disclaimer: I am not a financial advisor.

// For purpose educate only. Use at your own risk.

//#region <constant_declarations> {

//<my colors>

C_GREEN = #006400 //Green

C_GREENLIGHT = #388e3c //Green Light

C_RED = #8B0000 //Red

C_REDLIGHT = #b71c1c //Red Light

//#endregion }

//#region <inputs> {

i_dcLen = input.int (20, 'Length' , minval = 1)

//Display

G_DISPLAY = 'Display'

i_showBasis = input.bool (true, '■ Basis On/Off' , group = G_DISPLAY)

//i_alertOn = input.bool (false, '■ Alert On/Off' , group = G_DISPLAY)

//i_showFill = input.bool (false, '■ Fill On/Off' , group = G_DISPLAY)

i_showBarCol = input.bool (true, '■ Bar Color On/Off' , group = G_DISPLAY)

i_showClose = input.bool (false, '■ Close Alert On/Off' , group = G_DISPLAY)

//#endregion }

//#region <calculations> {

//<set initial values>

condition = 0.0

dc = 0.0

dcDirCond = 0.0

dcTopDir = 0.0

dcBotDir = 0.0

dcTop = ta.highest(i_dcLen)

dcBot = ta.lowest (i_dcLen)

dcBasis = math.avg(dcTop, dcBot)

dc := dc[1] != 1 and dcTop > dcTop[1] ? 1 :

dc[1] != -1 and dcBot < dcBot[1] ? -1 : nz(dc[1])

dcDirUp = dcTop > dcTop[1]

dcDirDn = dcBot < dcBot[1]

dcDirZero = ta.crossunder(close, dcBasis) or ta.crossover(close, dcBasis)

dcDirCond := dcDirCond[1] != 1 and dcDirUp ? 1 :

dcDirCond[1] != -1 and dcDirDn ? -1 :

dcDirCond[1] != 0 and dcDirZero ? 0 : nz(dcDirCond[1])

dcDir = dcDirCond == 0 ? 0 :

dc == 1 ? 1 : -1

dcTopDir := dcTop < dcTop[1] ? 0 :

dcTop > dcTop[1] ? 1 : nz(dcTopDir[1])

dcBotDir := dcBot > dcBot[1] ? 0 :

dcBot < dcBot[1] ? -1 : nz(dcBotDir[1])

dcRange = dcTopDir == 0 and dcBotDir == 0

//<rules>

longErule = dcTop > dcTop[1]

shortErule = dcBot < dcBot[1]

longXrule = i_showClose ? ta.crossunder(close, dcBasis) : false

shortXrule = i_showClose ? ta.crossover (close, dcBasis) : false

//<conditions>

condition := condition[1] != 1 and longErule ? 1 :

condition[1] != -1 and shortErule ? -1 :

condition[1] != 0 and longXrule ? 0 :

condition[1] != 0 and shortXrule ? 0 : nz(condition[1])

longE = condition[1] != 1 and condition == 1

shortE = condition[1] != -1 and condition == -1

longX = condition[1] == 1 and longXrule

shortX = condition[1] == -1 and shortXrule

// <color>

c_range = dcRange or condition == 0

c_dcTop = c_range ? color.new(color.gray, 75) :

condition == 1 ? color.new(color.green, 0) :

condition == 0 ? color.new(color.orange, 0) :

dcRange ? color.new(color.orange, 0) :

color.new(color.gray, 75)

c_dcBot = c_range ? color.new(color.gray, 75) :

condition == -1 ? color.new(color.red, 0) :

condition == 0 ? color.new(color.orange, 0) :

color.new(color.gray, 75)

c_dcBasis = dcRange ? color.new(color.orange, 0) :

dc == 1 ? color.new(color.green, 25) :

dc == -1 ? color.new(color.red, 25) : na

c_dcFill = dcRange ? color.new(color.orange, 80) :

dc == 1 ? color.new(color.green, 80) :

dc == -1 ? color.new(color.red, 80) : na

c_barCol = c_range and open <= close ? color.new(color.orange, 0) :

c_range and open > close ? color.new(color.yellow, 0) :

condition == 1 and open <= close ? color.new(C_GREEN, 0) :

condition == 1 and open > close ? color.new(color.green, 0) :

condition == -1 and open >= close ? color.new(C_RED, 0) :

condition == -1 and open < close ? color.new(color.red, 0) :

color.new(color.gray, 0)

//#endregion }

//#region <visuals> {

plot(

i_showBasis ? dcBasis : na,

title = 'Basis',

linewidth = 2,

color = c_dcBasis)

barcolor(i_showBarCol ? c_barCol : na)

//#endregion }

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ChartPrime

//@version=5

// Custom cosh function

cosh(float x) =>

(math.exp(x) + math.exp(-x)) / 2

// Custom acosh function

acosh(float x) =>

x < 1 ? na : math.log(x + math.sqrt(x * x - 1))

// Custom sinh function

sinh(float x) =>

(math.exp(x) - math.exp(-x)) / 2

// Custom asinh function

asinh(float x) =>

math.log(x + math.sqrt(x * x + 1))

// Custom inverse tangent function

atan(float x) =>

math.pi / 2 - math.atan(1 / x)

// Chebyshev Type I Moving Average

chebyshevI(float src, int len, float ripple) =>

a = 0.

b = 0.

g = 0.

chebyshev = 0.

a := cosh(1 / len * acosh(1 / (1 - ripple)))

b := sinh(1 / len * asinh(1 / ripple))

g := (a - b) / (a + b)

chebyshev := (1 - g) * src + g * nz(chebyshev[1])

chebyshev

bool_to_float(bool source) =>

source ? 1 : 0

ema(source)=>

var float ema = 0.0

var int count = 0

count := nz(count[1]) + 1

ema := (1.0 - 2.0 / (count + 1.0)) * nz(ema[1]) + 2.0 / (count + 1.0) * source

ema

atan2(y, x) =>

var float angle = 0.0

if x > 0

angle := math.atan(y / x)

else

if x < 0 and y >= 0

angle := math.atan(y / x) + math.pi

else

if x < 0 and y < 0

angle := math.atan(y / x) - math.pi

else

if x == 0 and y > 0

angle := math.pi / 2

else

if x == 0 and y < 0

angle := -math.pi / 2

angle

degrees(float source) =>

source * 180 / math.pi

tra()=>

atr = ema(ta.tr)

slope = (close - close[10]) / (atr * 10)

angle_rad = atan2(slope, 1)

degrees = degrees(angle_rad)

source = ta.sma((degrees > 0 ? high : low), 2)

mats(source, length) =>

smooth = 0.

higher_high = math.max(math.sign(ta.change(ta.highest(length))), 0)

lower_low = math.max(math.sign(ta.change(ta.lowest(length)) * -1), 0)

time_constant = math.pow(ta.sma(bool_to_float(higher_high or lower_low), length), 2)

smooth := nz(smooth[1] + time_constant * (source - smooth[1]), source)

wilders_period = length * 4 - 1

atr = math.abs(nz(smooth[1]) - smooth)

ma_atr = ta.ema(atr, wilders_period)

delta_fast_atr = ta.ema(ma_atr, wilders_period) * length * 0.4

result = 0.0

if smooth > nz(result[1])

if smooth - delta_fast_atr < result[1]

result := result[1]

else

result := smooth - delta_fast_atr

else

if smooth + delta_fast_atr > result[1]

result := result[1]

else

result := smooth + delta_fast_atr

// Return

result

length = input.int(20, "Length", 2)

up_color = input.color(color.blue, "", inline = "color")

down_color = input.color(color.orange, "", inline = "color")

enable_glow = input.bool(true, "Enable Glow", inline = "color")

mats = mats(tra(), length)

atr = ta.atr(length)

colour = ta.sma(close, 2) > mats ? up_color : down_color

atr_10 = ema(ta.tr) / 2

alpha = color.new(color.black, 100)

max = mats + atr_10

min = mats - atr_10

center = plot(mats, "Moving Average Trend Sniper", colour, editable = true)

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © jjustingreyy

//@version=5

// Input settings

atrLength = input(3, title="ATR Length")

thresholdMultiplier = input(1.5, title="Threshold Multiplier")

HTF = input.timeframe('', 'TimeFrame')

// Get data from the higher timeframe

[h_high, h_low, h_close] = request.security(syminfo.tickerid, HTF, [high, low, close])

// Calculate True Range and Average True Range

trueRange = math.max(math.max(h_high - h_low, math.abs(h_high - h_close[1])), math.abs(h_low - h_close[1]))

atr33 = ta.sma(trueRange, atrLength)

threshold = atr33 * thresholdMultiplier

// Determine if it's a high volatility candle

isHighVolatility = h_close > h_close[1] + threshold

// Line settings

last = input(5, 'Display last X lines')

lineLevel = isHighVolatility ? (h_close[1] > h_close ? h_high : h_low) : na

// Line management variables

var line[] mylines = array.new_line(0)

var bool[] mylinestyles = array.new_bool(0) // Store initial styles

var int[] crossCount = array.new_int(0) // Store cross counts

var float prevLineLevel = na

var int prevBarIndex = na

var bool prevState = na

// Draw trendlines

if isHighVolatility

if not na(prevLineLevel)

// Determine the initial color and style based on price action

initialColor = close[1] > lineLevel ? color.rgb(108, 240, 126) : color.red

initialStyle = close[1] > lineLevel ? line.style_solid : line.style_solid

// Create the new line and add it to the array

lineId = line.new(x1=prevBarIndex, y1=prevLineLevel, x2=bar_index[0], y2=lineLevel, xloc=xloc.bar_index, style=initialStyle, extend=array.size(mylines) == last - 1 ? extend.right : extend.none, color=initialColor, width=2)

array.push(mylines, lineId)

array.push(mylinestyles, initialStyle == line.style_solid) // Store the initial style as a boolean (true for solid)

array.push(crossCount, 0) // Initialize cross count for the new line

// Remove lines and associated data beyond the recent X amount of lines

if array.size(mylines) > last

line.delete(array.shift(mylines))

array.shift(mylinestyles)

array.shift(crossCount)

// Update previous line level and bar index

prevLineLevel := lineLevel

prevBarIndex := bar_index[0]

// Check for price crossing the trendline

var line closestLine = na

if array.size(mylines) > 0

closestLine := array.get(mylines, array.size(mylines) - 1)

crossOver = ta.crossover(close, line.get_price(closestLine, bar_index))

crossUnder = ta.crossunder(close, line.get_price(closestLine, bar_index))

// Declare isAboveLine variable

bool isAboveLine = na

// Update the color of the closest trendline based on price action

if array.size(mylines) > 0

isAboveLine := close >= line.get_price(closestLine, bar_index)

if na(prevState)

prevState := isAboveLine

if crossOver or crossUnder

// Increment the cross count

array.set(crossCount, array.size(crossCount) - 1, array.get(crossCount, array.size(crossCount) - 1) + 1)

// Check if the price has crossed the trendline twice

if array.get(crossCount, array.size(crossCount) - 1) >= 2

line.set_style(closestLine, line.style_dashed) // Set line style to dashed when the price crosses a red line

else

line.set_color(closestLine, isAboveLine ? color.rgb(108, 240, 126) : color.rgb(255, 82, 82))

prevState := isAboveLine

// Extend only the current line to the right

for i = 0 to array.size(mylines) - 1

line.set_extend(array.get(mylines, i), i == array.size(mylines) - 1 ? extend.right : extend.none)

Yer İmleri