By Jamie McGeever

LONDON, Jan 15 (Reuters) - The direction fast money is flowing at the start of the year could not be clearer as

hedge funds and speculators ramp up their bets on a lower dollar and higher U.S. bond yields.

Most of these bets are currently in the money. The dollar hit a three-year low on Monday, the 10-year Treasury yield last week rose to its highest since March, and the two-year yield is its highest since 2008.

But as U.S. currency and yields hit levels not seen in years,

the size of bets needed to get them there is also growing. Many of these positions are getting stretched, in some cases close to record levels, casting doubt on how much more they can expand and therefore keep the current trends intact.

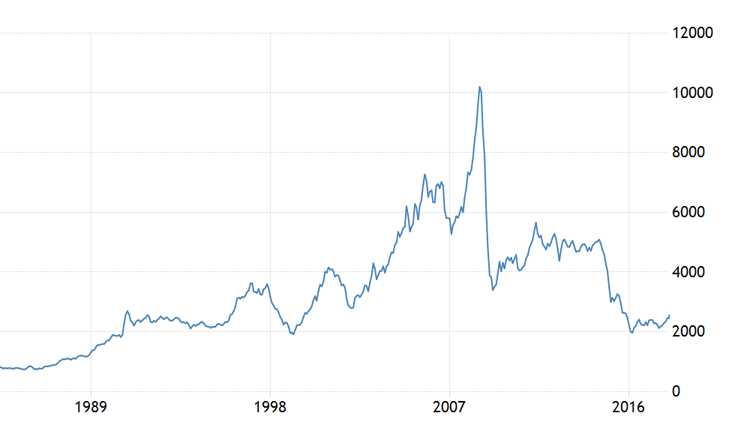

Data from the Chicago Futures Trading Commission show that hedge funds' and speculative accounts' short dollar position against a basket of major and emerging currencies virtually doubled in the week to Jan. 9, to $10.1 billion from $5.4 billion.

That is the largest net short dollar position since the end of October last year.

The U.S. currency is on the slide, hitting a three-year low on a trade-weighted basis on Monday. It fell 10 percent last year, its worst year since 2003, but the New Year has brought no cheer - it's down a further 1.8 percent in just two weeks.

Most of the FX market's bearish view on the dollar is rooted in its bullish view on the euro. Net long euro positions leapt to a new record 144,691 contracts from 127,868, according to CFTC. That's a $21.5 billion bet that the euro will strengthen.

Yer İmleri