https://tr.tradingview.com/v/NIuGTgAO/

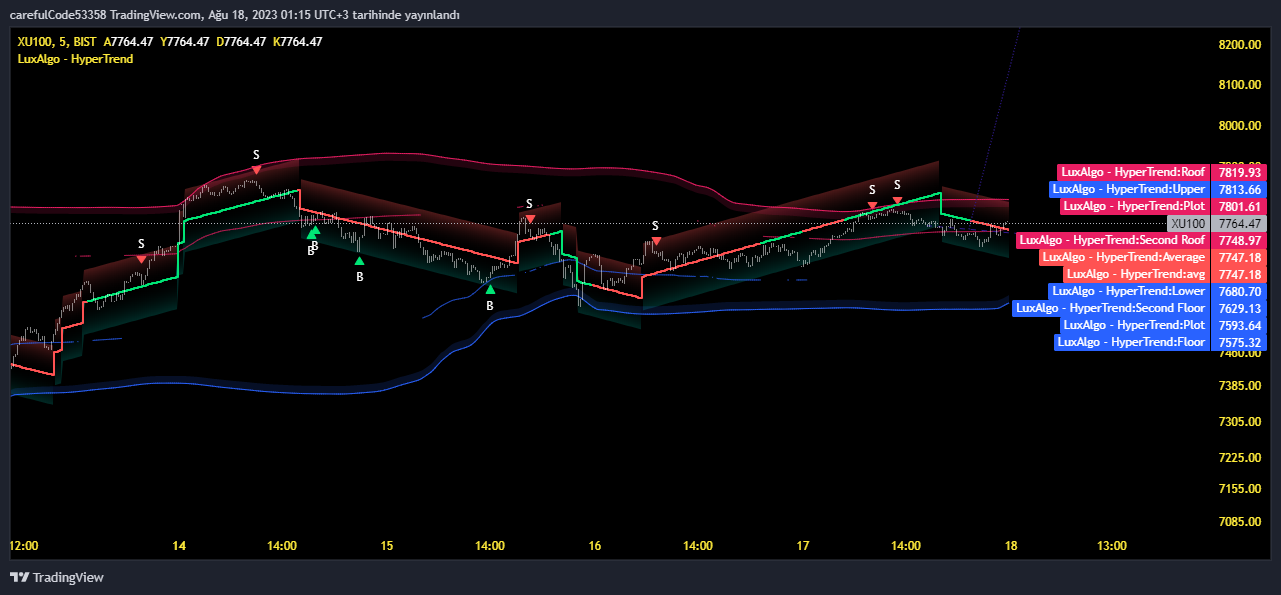

pivota göre trend çekiyor...rakamlar küçültülebilir....

https://tr.tradingview.com/v/NIuGTgAO/

pivota göre trend çekiyor...rakamlar küçültülebilir....

16.07.2024 - 10.12.2024

https://tr.tradingview.com/v/m0G2Xv7r/

otomatik mft var....

16.07.2024 - 10.12.2024

16.07.2024 - 10.12.2024

https://tr.tradingview.com/v/5Q0rRNo6/

çift bolinger...

16.07.2024 - 10.12.2024

https://tr.tradingview.com/v/zvy7J87b/ bunu ana trend ve ileri projeksiyon olarak düşünün...

https://tr.tradingview.com/v/ZXIm3q7G/ bunu rsı ccı gibi....hazır strateji olarak düşünün....

https://tr.tradingview.com/v/Bcufg8oX/ bunu dip tepeler için kanal düşünün.....

https://tr.tradingview.com/v/zLGM4F2M/ bunu destek ve direnç olarak düşünün....

16.07.2024 - 10.12.2024

bu dördünü bir sistem olarak düşünün...

kodların birleşmiş hali....

istediğiniz değişiklilrei ve ayarlamaları yapın.....PHP Code:// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=5

indicator("HyperTrend [LuxAlgo]", "LuxAlgo - HyperTrend", overlay = true)

//------------------------------------------------------------------------------

//Settings

//-----------------------------------------------------------------------------{

mult = input.float(5, 'Multiplicative Factor', minval = 0)

slope = input.float(14, 'Slope', minval = 0)

width = input.float(80, 'Width %', minval = 0, maxval = 100) / 100

//Style

bullCss = input.color(color.teal, 'Average Color', inline = 'avg', group = 'Style')

bearCss = input.color(color.red, '' , inline = 'avg', group = 'Style')

area = input.string('Gradient', 'Area', options = ['Gradient', 'Solid'], group = 'Style')

upperCss = input.color(color.new(color.red, 70), 'Upper Area', group = 'Style')

lowerCss = input.color(color.new(color.teal, 70) , 'Lower Area', group = 'Style')

//-----------------------------------------------------------------------------}

//Calculation

//-----------------------------------------------------------------------------{

var float upper = na

var float lower = na

var float avg = close

var hold = 0.

var os = 1.

atr = nz(ta.atr(200)) * mult

avg := math.abs(close - avg) > atr ?

math.avg(close, avg)

: avg + os * (hold / mult / slope)

os := math.sign(avg - avg[1])

hold := os != os[1] ? atr : hold

upper := avg + width * hold

lower := avg - width * hold

//-----------------------------------------------------------------------------}

//Plots

//-----------------------------------------------------------------------------{

css = os == 1 ? bullCss : bearCss

plot_upper = plot(upper, 'Upper', na)

plot_avg = plot(avg, 'Average', os != os[1] ? na : css)

plot_lower = plot(lower, 'Lower', na)

var color upper_topcol = na

var color upper_btmcol = na

var color lower_topcol = na

var color lower_btmcol = na

//Fill

if area == 'Gradient'

upper_topcol := upperCss

upper_btmcol := color.new(chart.bg_color, 100)

lower_topcol := color.new(chart.bg_color, 100)

lower_btmcol := lowerCss

else

upper_topcol := upperCss

upper_btmcol := upperCss

lower_topcol := lowerCss

lower_btmcol := lowerCss

//Upper Area

fill(plot_upper, plot_avg

, top_color = os != os[1] ? na : upper_topcol

, bottom_color = os != os[1] ? na : upper_btmcol

, top_value = upper

, bottom_value = avg)

//Lower Area

fill(plot_avg, plot_lower

, top_color = os != os[1] ? na : lower_topcol

, bottom_color = os != os[1] ? na : lower_btmcol

, top_value = avg

, bottom_value = lower)

//-----------------------------------------------------------------------------}

//

//rodavlas12

//@version=5

// Input settings

ccimomCross = input.string('CCI', 'Entry Signal Source', options=['CCI', 'Momentum'], tooltip='CCI or Momentum will be the final source of the Entry signal if selected.')

ccimomLength = input.int(10, minval=1, title='CCI/Momentum Length')

useDivergence = input.bool(true, title='Find Regular Bullish/Bearish Divergence', tooltip='If checked, it will only consider an overbought or oversold condition that has a regular bullish or bearish divergence formed inside that level.')

rsiOverbought = input.int(65, minval=1, title='RSI Overbought Level', tooltip='Adjusting the level to extremely high may filter out some signals especially when the option to find divergence is checked.')

rsiOversold = input.int(35, minval=1, title='RSI Oversold Level', tooltip='Adjusting this level extremely low may filter out some signals especially when the option to find divergence is checked.')

rsiLength = input.int(14, minval=1, title='RSI Length')

plotMeanReversion = input.bool(false, 'Plot Mean Reversion Bands on the chart', tooltip='This function doesn\'t affect the entry of signal but it suggests buying when the price is at the lower band, and then sell it on the next bounce at the higher bands.')

emaPeriod = input(200, title='Lookback Period (EMA)')

bandMultiplier = input.float(1.8, title='Outer Bands Multiplier', tooltip='Multiplier for both upper and lower bands')

// CCI and Momentum calculation

momLength = ccimomCross == 'Momentum' ? ccimomLength : 10

mom = close - close[momLength]

cci = ta.cci(close, ccimomLength)

ccimomCrossUp = ccimomCross == 'Momentum' ? ta.cross(mom, 0) : ta.cross(cci, 0)

ccimomCrossDown = ccimomCross == 'Momentum' ? ta.cross(0, mom) : ta.cross(0, cci)

// RSI calculation

src = close

up = ta.rma(math.max(ta.change(src), 0), rsiLength)

down = ta.rma(-math.min(ta.change(src), 0), rsiLength)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

oversoldAgo = rsi[0] <= rsiOversold or rsi[1] <= rsiOversold or rsi[2] <= rsiOversold or rsi[3] <= rsiOversold

overboughtAgo = rsi[0] >= rsiOverbought or rsi[1] >= rsiOverbought or rsi[2] >= rsiOverbought or rsi[3] >= rsiOverbought

// Regular Divergence Conditions

bullishDivergenceCondition = rsi[0] > rsi[1] and rsi[1] < rsi[2]

bearishDivergenceCondition = rsi[0] < rsi[1] and rsi[1] > rsi[2]

// Entry Conditions

longEntryCondition = ccimomCrossUp and oversoldAgo and (not useDivergence or bullishDivergenceCondition)

shortEntryCondition = ccimomCrossDown and overboughtAgo and (not useDivergence or bearishDivergenceCondition)

// Mean Reversion Indicator

meanReversion = plotMeanReversion ? ta.ema(close, emaPeriod) : na

stdDev = plotMeanReversion ? ta.stdev(close, emaPeriod) : na

upperBand = plotMeanReversion ? meanReversion + stdDev * bandMultiplier : na

lowerBand = plotMeanReversion ? meanReversion - stdDev * bandMultiplier : na

// Plotting

plotshape(longEntryCondition, title='BUY', style=shape.triangleup, text='B', location=location.belowbar, color=color.new(color.lime, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(shortEntryCondition, title='SELL', style=shape.triangledown, text='S', location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plot(upperBand, title='Upper Band', color=color.new(color.fuchsia, 0), linewidth=1)

plot(meanReversion, title='Mean', color=color.new(color.gray, 0), linewidth=1)

plot(lowerBand, title='Lower Band', color=color.new(color.blue, 0), linewidth=1)

// Entry signal alerts

alertcondition(longEntryCondition, title='BUY Signal', message='Buy Entry Signal')

alertcondition(shortEntryCondition, title='SELL Signal', message='Sell Entry Signal')

alertcondition(longEntryCondition or shortEntryCondition, title='BUY or SELL Signal', message='Entry Signal')

////////////////////////////////////////////

// © TommasoRossini

//@version=5

lnt = input(200, "Lenght")

lnt2 = input.int(10, "Smooth", minval = 1)

lnt3 = input.float(1.00, "Zone Width", minval = 0.5, maxval = 3, step = 0.25)

downcol = input.color(#e91e63, "Premium color")

upcol = input.color(#2962ff, "Discount color")

atrs = ta.sma(ta.atr(lnt), lnt) * lnt3

max = ta.highest(high, lnt)

min = ta.lowest(low, lnt)

[middle, upper11, lower11] = ta.bb(close, lnt, 2)

upfirst = ta.sma(math.avg(max, upper11), lnt2)

downfirst = ta.sma(math.avg(min, lower11), lnt2)

upsecond = upfirst + atrs

downsecond = downfirst - atrs

average = math.avg(upfirst, downfirst, math.avg(max, min))

upavg = math.avg(average, upfirst)

downavg = math.avg(average, downfirst)

p1 = plot(upfirst, color = color.new(downcol, 100), editable = false)

p2 = plot(upsecond, color = color.new(downcol, 0), title = "Roof")

p3 = plot(downfirst, color = color.new(upcol, 100), editable = false)

p4 = plot(downsecond, color = color.new(upcol, 0), title = "Floor")

fill(p1, p2, color = color.new(downcol, 85), title = "Roof fill")

fill(p3, p4, color = color.new(upcol, 85), title = "Floor fill")

plot(close > middle ? upavg : na, color = color.new(downcol, 25), style = plot.style_linebr, title = "Second Roof")

plot(close < middle ? downavg : na, color = color.new(upcol, 25), style = plot.style_linebr, title = "Second Floor")

///////////////////////////////////////////////////////////

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © RicardoSantos, midtownsk8rguy

// Cycle functions by: midtownsk8rguy

// https://www.tradingview.com/script/wyyXKHDn-Correlation-Cycle-CorrelationAngle-Market-State-John-Ehlers/

rad2deg(Rad) => // Radians To Degrees

var DEGREES_IN_1_RADIAN = 90.0 / math.asin(1.0) // 57.29577951308 Constant

Rad * DEGREES_IN_1_RADIAN

cc(Series, Period) => // Correlation Cycle Function

var PIx2 = 4.0 * math.asin(1.0) // 6.28318530718 Constant

period = math.max(2, Period)

Rx = 0.0

Rxx = 0.0

Rxy = 0.0

Ryy = 0.0

Ry = 0.0

Ix = 0.0

Ixx = 0.0

Ixy = 0.0

Iyy = 0.0

Iy = 0.0

for i = 1 to period by 1

iMinusOne = i - 1

X = nz(Series[iMinusOne])

temp = PIx2 * iMinusOne / period

Yc = math.cos(temp)

Ys = -math.sin(temp)

Rx += X

Ix += X

Rxx += X * X

Ixx += X * X

Rxy += X * Yc

Ixy += X * Ys

Ryy += Yc * Yc

Iyy += Ys * Ys

Ry += Yc

Iy += Ys

Iy

realPart = 0.0

temp_1 = period * Rxx - Rx * Rx

temp_2 = period * Ryy - Ry * Ry

if temp_1 > 0.0 and temp_2 > 0.0

realPart := (period * Rxy - Rx * Ry) / math.sqrt(temp_1 * temp_2)

realPart

imagPart = 0.0

temp_1 := period * Ixx - Ix * Ix

temp_2 := period * Iyy - Iy * Iy

if temp_1 > 0.0 and temp_2 > 0.0

imagPart := (period * Ixy - Ix * Iy) / math.sqrt(temp_1 * temp_2)

imagPart

[realPart, imagPart]

cap(RealPart, ImaginaryPart) => // Correlation Angle Phasor Function

var HALF_OF_PI = math.asin(1.0) // 1.57079632679 Constant

angle = ImaginaryPart == 0.0 ? 0.0 : rad2deg(math.atan(RealPart / ImaginaryPart) + HALF_OF_PI)

if ImaginaryPart > 0.0

angle -= 180.0

angle

priorAngle = nz(angle[1])

if priorAngle > angle and priorAngle - angle < 270.0

angle := priorAngle

angle

angle

//------------------------------------------------------------------------------

int length = input(20)

bool use_automatic_selection = input(false)

float cycle_length = length

if use_automatic_selection

[_real, _imag] = cc(close, length)

cycle_length := math.round(cap(_real, _imag))

cycle_length

bool is_new_cycle = false

if bar_index % cycle_length == cycle_length - 1

is_new_cycle := true

is_new_cycle

var float avg11 = open

var color pl_color = color.new(color.gray, 0)

var bool is_up = na

var line li_slope = line.new(x1=bar_index, y1=open, x2=bar_index, y2=open, xloc=xloc.bar_index, extend=extend.right, color=color.navy, style=line.style_dotted, width=1)

var line li_trend = line.new(x1=bar_index, y1=open, x2=bar_index, y2=open, xloc=xloc.bar_index, extend=extend.right, color=color.navy, style=line.style_dashed, width=1)

var float max11 = high

var float min11 = low

if high > max11

max11 := math.max(high, avg11)

max11

if low < min

min11 := math.min(low, avg11)

min11

if is_new_cycle

avg11 := (nz(avg11) * (1 + 1 / cycle_length) + close * (1 - 1 / cycle_length)) / 2

max11 := high

min11 := low

if avg11 > avg11[1]

is_up := true

pl_color := color.new(color.lime, 0)

if not is_up[1]

line.set_xy1(id=li_trend, x=line.get_x1(id=li_slope), y=avg11[1])

line.set_xy2(id=li_trend, x=bar_index[0], y=avg11)

else

line.set_xy2(id=li_trend, x=bar_index[0], y=avg11)

if avg11 < avg11[1]

is_up := false

pl_color := color.new(color.red, 0)

if is_up[1]

line.set_xy1(id=li_trend, x=line.get_x1(id=li_slope), y=avg11[1])

line.set_xy2(id=li_trend, x=bar_index[0], y=avg11)

else

line.set_xy2(id=li_trend, x=bar_index[0], y=avg11)

line.set_x1(id=li_slope, x=bar_index[1])

line.set_xy2(id=li_slope, x=bar_index[0], y=avg)

// line.new(x1=bar_index[cycle_length], y1=avg[cycle_length], x2=bar_index[0], y2=avg[0], xloc=xloc.bar_index, extend=extend.right, color=color.blue, style=line.style_dotted, width=1)

if is_up

line.set_y1(id=li_slope, y=avg - (max11 - min11) / cycle_length)

else

line.set_y1(id=li_slope, y=avg + (max11 - min11) / cycle_length)

plot(series=avg, title='avg', color=pl_color, linewidth=2, style=plot.style_stepline)

görüntü....

16.07.2024 - 10.12.2024

https://www.tradingview.com/x/KV6UoDk1/PHP Code:// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=5

indicator("*", overlay = true)

//------------------------------------------------------------------------------

//Settings

//-----------------------------------------------------------------------------{

mult = input.float(5, 'Multiplicative Factor', minval = 0)

slope = input.float(14, 'Slope', minval = 0)

width = input.float(80, 'Width %', minval = 0, maxval = 100) / 100

//Style

bullCss = input.color(color.yellow, 'Average Color', inline = 'avg', group = 'Style')

bearCss = input.color(color.aqua, '' , inline = 'avg', group = 'Style')

area = input.string('Gradient', 'Area', options = ['Gradient', 'Solid'], group = 'Style')

upperCss = input.color(color.new(color.aqua, 70), 'Upper Area', group = 'Style')

lowerCss = input.color(color.new(color.yellow, 70) , 'Lower Area', group = 'Style')

//-----------------------------------------------------------------------------}

//Calculation

//-----------------------------------------------------------------------------{

var float upper = na

var float lower = na

var float avg = close

var hold = 0.

var os = 1.

atr = nz(ta.atr(200)) * mult

avg := math.abs(close - avg) > atr ?

math.avg(close, avg)

: avg + os * (hold / mult / slope)

os := math.sign(avg - avg[1])

hold := os != os[1] ? atr : hold

upper := avg + width * hold

lower := avg - width * hold

//-----------------------------------------------------------------------------}

//Plots

//-----------------------------------------------------------------------------{

css = os == 1 ? bullCss : bearCss

plot_upper = plot(upper, 'Yüksek', na)

plot_avg = plot(avg, 'Ortalama', os != os[1] ? na : css)

plot_lower = plot(lower, 'Düşük', na)

var color upper_topcol = na

var color upper_btmcol = na

var color lower_topcol = na

var color lower_btmcol = na

//Fill

if area == 'Gradient'

upper_topcol := upperCss

upper_btmcol := color.new(chart.bg_color, 100)

lower_topcol := color.new(chart.bg_color, 100)

lower_btmcol := lowerCss

else

upper_topcol := upperCss

upper_btmcol := upperCss

lower_topcol := lowerCss

lower_btmcol := lowerCss

//Upper Area

fill(plot_upper, plot_avg

, top_color = os != os[1] ? na : upper_topcol

, bottom_color = os != os[1] ? na : upper_btmcol

, top_value = upper

, bottom_value = avg)

//Lower Area

fill(plot_avg, plot_lower

, top_color = os != os[1] ? na : lower_topcol

, bottom_color = os != os[1] ? na : lower_btmcol

, top_value = avg

, bottom_value = lower)

//-----------------------------------------------------------------------------}

//

//rodavlas12

//@version=5

// Input settings

ccimomCross = input.string('CCI', 'Entry Signal Source', options=['CCI', 'Momentum'], tooltip='CCI or Momentum will be the final source of the Entry signal if selected.')

ccimomLength = input.int(10, minval=1, title='CCI/Momentum Length')

useDivergence = input.bool(true, title='Find Regular Bullish/Bearish Divergence', tooltip='If checked, it will only consider an overbought or oversold condition that has a regular bullish or bearish divergence formed inside that level.')

rsiOverbought = input.int(65, minval=1, title='RSI Overbought Level', tooltip='Adjusting the level to extremely high may filter out some signals especially when the option to find divergence is checked.')

rsiOversold = input.int(35, minval=1, title='RSI Oversold Level', tooltip='Adjusting this level extremely low may filter out some signals especially when the option to find divergence is checked.')

rsiLength = input.int(14, minval=1, title='RSI Length')

plotMeanReversion = input.bool(false, 'Plot Mean Reversion Bands on the chart', tooltip='This function doesn\'t affect the entry of signal but it suggests buying when the price is at the lower band, and then sell it on the next bounce at the higher bands.')

emaPeriod = input(200, title='Lookback Period (EMA)')

bandMultiplier = input.float(1.8, title='Outer Bands Multiplier', tooltip='Multiplier for both upper and lower bands')

// CCI and Momentum calculation

momLength = ccimomCross == 'Momentum' ? ccimomLength : 10

mom = close - close[momLength]

cci = ta.cci(close, ccimomLength)

ccimomCrossUp = ccimomCross == 'Momentum' ? ta.cross(mom, 0) : ta.cross(cci, 0)

ccimomCrossDown = ccimomCross == 'Momentum' ? ta.cross(0, mom) : ta.cross(0, cci)

// RSI calculation

src = close

up = ta.rma(math.max(ta.change(src), 0), rsiLength)

down = ta.rma(-math.min(ta.change(src), 0), rsiLength)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

oversoldAgo = rsi[0] <= rsiOversold or rsi[1] <= rsiOversold or rsi[2] <= rsiOversold or rsi[3] <= rsiOversold

overboughtAgo = rsi[0] >= rsiOverbought or rsi[1] >= rsiOverbought or rsi[2] >= rsiOverbought or rsi[3] >= rsiOverbought

// Regular Divergence Conditions

bullishDivergenceCondition = rsi[0] > rsi[1] and rsi[1] < rsi[2]

bearishDivergenceCondition = rsi[0] < rsi[1] and rsi[1] > rsi[2]

// Entry Conditions

longEntryCondition = ccimomCrossUp and oversoldAgo and (not useDivergence or bullishDivergenceCondition)

shortEntryCondition = ccimomCrossDown and overboughtAgo and (not useDivergence or bearishDivergenceCondition)

// Mean Reversion Indicator

meanReversion = plotMeanReversion ? ta.ema(close, emaPeriod) : na

stdDev = plotMeanReversion ? ta.stdev(close, emaPeriod) : na

upperBand = plotMeanReversion ? meanReversion + stdDev * bandMultiplier : na

lowerBand = plotMeanReversion ? meanReversion - stdDev * bandMultiplier : na

// Plotting

plotshape(longEntryCondition, title='BUY', style=shape.triangleup, text='B', location=location.belowbar, color=color.new(color.lime, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(shortEntryCondition, title='SELL', style=shape.triangledown, text='S', location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

//plot(upperBand, title='Upper Band', color=color.new(color.fuchsia, 0), linewidth=1)

//plot(meanReversion, title='Mean', color=color.new(color.gray, 0), linewidth=1)

//plot(lowerBand, title='Lower Band', color=color.new(color.blue, 0), linewidth=1)

// Entry signal alerts

//alertcondition(longEntryCondition, title='BUY Signal', message='Buy Entry Signal')

//alertcondition(shortEntryCondition, title='SELL Signal', message='Sell Entry Signal')

//alertcondition(longEntryCondition or shortEntryCondition, title='BUY or SELL Signal', message='Entry Signal')

////////////////////////////////////////////

// © TommasoRossini

//@version=5

lnt = input(200, "Lenght")

lnt2 = input.int(10, "Smooth", minval = 1)

lnt3 = input.float(1.00, "Zone Width", minval = 0.5, maxval = 3, step = 0.25)

downcol = input.color(#e91e6200, "Premium color")

upcol = input.color(#2962ff00, "Discount color")

atrs = ta.sma(ta.atr(lnt), lnt) * lnt3

max = ta.highest(high, lnt)

min = ta.lowest(low, lnt)

[middle, upper11, lower11] = ta.bb(close, lnt, 2)

upfirst = ta.sma(math.avg(max, upper11), lnt2)

downfirst = ta.sma(math.avg(min, lower11), lnt2)

upsecond = upfirst + atrs

downsecond = downfirst - atrs

average = math.avg(upfirst, downfirst, math.avg(max, min))

upavg = math.avg(average, upfirst)

downavg = math.avg(average, downfirst)

p1 = plot(upfirst, color = color.new(downcol, 100), editable = false)

p2 = plot(upsecond, color = color.new(downcol, 0), title = "Direnç")

p3 = plot(downfirst, color = color.new(upcol, 100), editable = false)

p4 = plot(downsecond, color = color.new(upcol, 0), title = "Destek")

//fill(p1, p2, color = color.new(downcol, 85), title = "Roof fill")

//fill(p3, p4, color = color.new(upcol, 85), title = "Floor fill")

plot(close > middle ? upavg : na, color = color.new(downcol, 100), style = plot.style_linebr, title = "Yukarı Kırılım")

plot(close < middle ? downavg : na, color = color.new(upcol, 100), style = plot.style_linebr, title = "Aşağı Kırılım")

///////////////////////////////////////////////////////////

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © RicardoSantos, midtownsk8rguy

// Cycle functions by: midtownsk8rguy

// https://www.tradingview.com/script/wyyXKHDn-Correlation-Cycle-CorrelationAngle-Market-State-John-Ehlers/

rad2deg(Rad) => // Radians To Degrees

var DEGREES_IN_1_RADIAN = 90.0 / math.asin(1.0) // 57.29577951308 Constant

Rad * DEGREES_IN_1_RADIAN

cc(Series, Period) => // Correlation Cycle Function

var PIx2 = 4.0 * math.asin(1.0) // 6.28318530718 Constant

period = math.max(2, Period)

Rx = 0.0

Rxx = 0.0

Rxy = 0.0

Ryy = 0.0

Ry = 0.0

Ix = 0.0

Ixx = 0.0

Ixy = 0.0

Iyy = 0.0

Iy = 0.0

for i = 1 to period by 1

iMinusOne = i - 1

X = nz(Series[iMinusOne])

temp = PIx2 * iMinusOne / period

Yc = math.cos(temp)

Ys = -math.sin(temp)

Rx += X

Ix += X

Rxx += X * X

Ixx += X * X

Rxy += X * Yc

Ixy += X * Ys

Ryy += Yc * Yc

Iyy += Ys * Ys

Ry += Yc

Iy += Ys

Iy

realPart = 0.0

temp_1 = period * Rxx - Rx * Rx

temp_2 = period * Ryy - Ry * Ry

if temp_1 > 0.0 and temp_2 > 0.0

realPart := (period * Rxy - Rx * Ry) / math.sqrt(temp_1 * temp_2)

realPart

imagPart = 0.0

temp_1 := period * Ixx - Ix * Ix

temp_2 := period * Iyy - Iy * Iy

if temp_1 > 0.0 and temp_2 > 0.0

imagPart := (period * Ixy - Ix * Iy) / math.sqrt(temp_1 * temp_2)

imagPart

[realPart, imagPart]

cap(RealPart, ImaginaryPart) => // Correlation Angle Phasor Function

var HALF_OF_PI = math.asin(1.0) // 1.57079632679 Constant

angle = ImaginaryPart == 0.0 ? 0.0 : rad2deg(math.atan(RealPart / ImaginaryPart) + HALF_OF_PI)

if ImaginaryPart > 0.0

angle -= 180.0

angle

priorAngle = nz(angle[1])

if priorAngle > angle and priorAngle - angle < 270.0

angle := priorAngle

angle

angle

//------------------------------------------------------------------------------

int length = input(23)

bool use_automatic_selection = input(false)

float cycle_length = length

if use_automatic_selection

[_real, _imag] = cc(close, length)

cycle_length := math.round(cap(_real, _imag))

cycle_length

bool is_new_cycle = false

if bar_index % cycle_length == cycle_length - 1

is_new_cycle := true

is_new_cycle

var float avg11 = open

var color pl_color = color.new(color.gray, 0)

var bool is_up = na

var line li_slope = line.new(x1=bar_index, y1=open, x2=bar_index, y2=open, xloc=xloc.bar_index, extend=extend.right, color=color.yellow, style=line.style_dotted, width=2)

var line li_trend = line.new(x1=bar_index, y1=open, x2=bar_index, y2=open, xloc=xloc.bar_index, extend=extend.right, color=color.yellow, style=line.style_dashed, width=2)

var float max11 = high

var float min11 = low

if high > max11

max11 := math.max(high, avg11)

max11

if low < min

min11 := math.min(low, avg11)

min11

if is_new_cycle

avg11 := (nz(avg11) * (1 + 1 / cycle_length) + close * (1 - 1 / cycle_length)) / 2

max11 := high

min11 := low

if avg11 > avg11[1]

is_up := true

pl_color := color.new(color.lime, 0)

if not is_up[1]

line.set_xy1(id=li_trend, x=line.get_x1(id=li_slope), y=avg11[1])

line.set_xy2(id=li_trend, x=bar_index[0], y=avg11)

else

line.set_xy2(id=li_trend, x=bar_index[0], y=avg11)

if avg11 < avg11[1]

is_up := false

pl_color := color.new(color.red, 0)

if is_up[1]

line.set_xy1(id=li_trend, x=line.get_x1(id=li_slope), y=avg11[1])

line.set_xy2(id=li_trend, x=bar_index[0], y=avg11)

else

line.set_xy2(id=li_trend, x=bar_index[0], y=avg11)

line.set_x1(id=li_slope, x=bar_index[1])

line.set_xy2(id=li_slope, x=bar_index[0], y=avg)

// line.new(x1=bar_index[cycle_length], y1=avg[cycle_length], x2=bar_index[0], y2=avg[0], xloc=xloc.bar_index, extend=extend.right, color=color.blue, style=line.style_dotted, width=1)

if is_up

line.set_y1(id=li_slope, y=avg - (max11 - min11) / cycle_length)

else

line.set_y1(id=li_slope, y=avg + (max11 - min11) / cycle_length)

plot(series=avg, title='Trend', color=pl_color, linewidth=2, style=plot.style_stepline)

16.07.2024 - 10.12.2024

16.07.2024 - 10.12.2024

Yer İmleri