Tuvalet kagidinin yillar icindeki degisimi

Dolar kazaniyoruz ama emerging markets taki enflasyon o kadar yuksekki ve dolarin degeri o kadar dusukki TR de ayni hizmet ve mal icin her sene daha fazla dolar harcamak zorunda kaliyoruz. Yani Turkcesi; dolar her gun kan kaybediyor.

https://www.bloomberg.com/gadfly/art...rket-investors

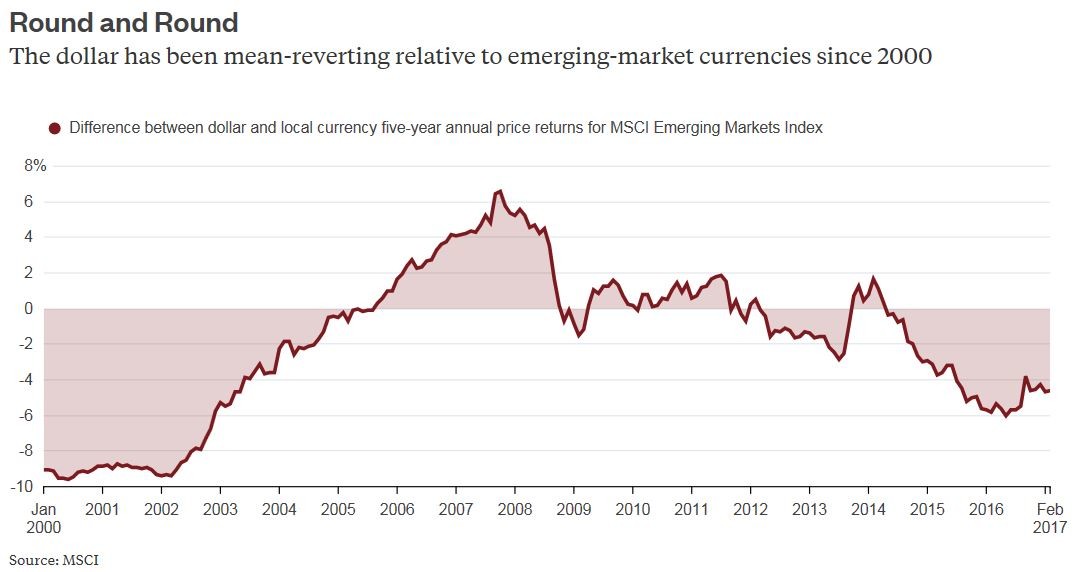

That makes intuitive sense. As developing economies become larger and more stable, their currencies become more stable, too, and less susceptible to meltdowns. When that happens, the return from the dollar relative to those foreign currencies should approach zero over time, which is what has happened over the last two decades.

The annual price return for the MSCI Emerging Markets Index has been 4.6 percentage points lower in dollars than in local currency over the most recent five years through February. That’s well above the average gap of 1.9 percentage points since 2000, which implies that the dollar should weaken rather than strengthen in the years ahead. That should be more good news for emerging-market investors.

Yer İmleri